Volt Lithium Corp.

OTCQB: VLTLF, TSX-V: VLT, FSE: I2D

The Revolutionary Impact of Direct Lithium Extraction on the Burgeoning EV Market | 06/21/2023 |

Volt’s Extraction Technology is Leading the Charge

With an escalating surge in demand for electric vehicles, 2022 witnessed record-breaking sales, a trend projected to persist and even intensify this year. The implications for associated industries are immense. One pivotal aspect which remains relatively obscured to the broader public, however, is the essential role of lithium extraction technology in meeting electric vehicle manufacturing targets.

The lithium element forms an indispensable component of electric vehicle batteries, with the automotive industry as a whole necessitating an unprecedented 20x increase in lithium supply. Hence, the burgeoning production of electric vehicles directly translates into a heightened requirement for efficient lithium extraction. Leading the charge in this sphere is Volt Lithium Corp.

Volt Lithium Corp. (TSX-V: VLT, OTCQB: VLTLF, FSE:I2D) (“Volt” or the “Company”) is revolutionizing the lithium extraction industry. Leveraging an extraction technology that yields high lithium recoveries at lower costs, Volt demonstrates an innovatively ambitious approach towards development, setting a unique standard in the sector.

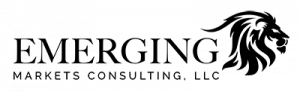

In the face of increasing global lithium demand, companies have been spurred to explore new methods of mining. Notably, Volt has distinguished itself as a trailblazer, pioneering previously unexplored strategies. The company employs Direct Lithium Extraction (DLE) technology, a two-step extraction process that ensures high yields at reduced costs. First, it treats oilfield brine to eliminate contaminants, followed by the extraction of lithium using the Company’s proprietary IES-300 technology. The end result is a lithium chloride solution, which is further upgraded to lithium hydroxide. The IES-300 technology significantly reduces the amount of reagent required to treat oilfield brine at the outset of the extraction process, thus facilitating substantial cost savings.

Volt’s Direct Lithium Extraction (DLE) Technology

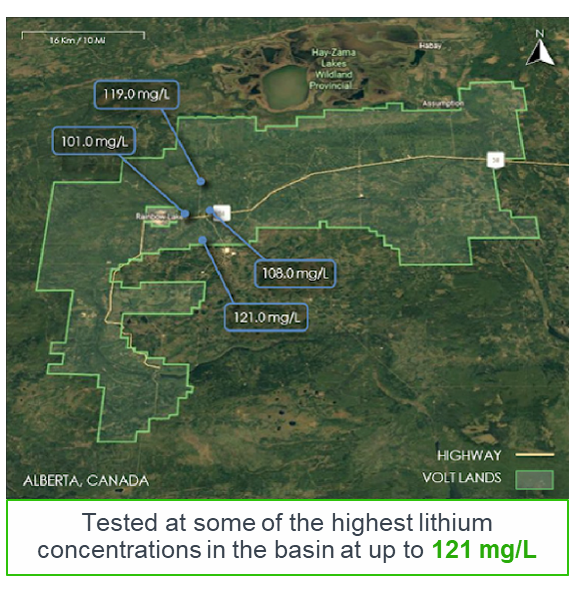

The company’s recently announced pilot project demonstrated lithium recoveries of 90% at concentrations as low as 34 mg/L. Under simulated operating conditions at concentrations of 120mg/L, recovery rates surged to a staggering 97%, with operating costs dipping below CAD$4,000 per tonne, considering an average annual production of 20,000 tonnes of Lithium Hydroxide Monohydrate (LHM).

Moreover, Volt’s pilot project corroborated the company’s potential for extracting lithium efficiently from low concentration brine at their Rainbow Lake Property. At the same time, they showcased superior economics when compared to other lithium brine developers at higher concentrations. These pioneering results set a promising foundation for commercial lithium extraction from multiple oilfield reservoirs across North America using Volt’s proprietary DLE process.

Volt Lithium Corp. has emerged as a disruptive force in the industry, transforming traditional methodologies and is a company worthy of close attention, particularly in light of soaring lithium demand.

The Company’s unique speed in an industry typically characterized by gradual progress in bringing new resources online and to market is largely attributed to two key factors. First, Volt’s work with brine, which is easier to ‘mine’ than hard rock, requiring only the pumping of brine to the surface. This innovation has positioned Volt as a “briner”, not a miner, a distinction that sets them apart from traditional players in the industry. Second, Volt’s shared infrastructure agreement with existing oil field operators allows them to reach production swiftly and inexpensively, compared to hard rock miners and even other briners.

As North American manufacturing undergoes rapid onshoring and as the EV revolution spurs global demand, it is crucial to expedite new sources and ensure they are brought online domestically.

With its disruptive technology and innovative approach, Volt Lithium Corp. is not only positioned to meet the burgeoning demand for lithium but also to scale its operations rapidly. The DLE technology deployed by the company is modular by nature, necessitating the mere addition of equipment at the surface of producing oilfields. This straightforward integration into existing infrastructure presents an unprecedented scalability that traditional lithium mining methods simply cannot offer. Consequently, Volt has the potential to expedite the commissioning of multiple lithium extraction sources across North America. This timely response to the soaring demand for lithium positions Volt as a vanguard in the lithium extraction sector, promising to fuel the growth of the EV market, and to contribute significantly to the domestic sourcing of lithium. As we stand on the brink of a possible transportation revolution, Volt Lithium Corp.’s contributions may prove pivotal in ensuring a sustainable and economically viable transition to electric vehicles.

Volt Lithium Corp.:

Volt is a lithium development and technology company aiming to be North America’s first commercial producer of lithium hydroxide and lithium carbonates from oilfield brine. Their strategy is to generate value for shareholders by leveraging management’s hydrocarbon experience and existing infrastructure to extract lithium deposits from existing wells, thereby reducing capital costs, lowering risks and supporting the world’s clean energy transition. With four differentiating pillars, and a proprietary Direct Lithium Extraction (“DLE”) technology, Volt’s innovative approach to development is focused on allowing the highest lithium recoveries with lowest costs, positioning them well for future commercialization. They are committed to operating efficiently and with transparency across all areas of the business staying sharply focused on creating long-term, sustainable shareholder value.

About The Emerging Markets Report:

The Emerging Markets Report is owned and operated by Emerging Markets Consulting (EMC), a syndicate of investor relations consultants representing years of experience. Our network consists of stockbrokers, investment bankers, fund managers, and institutions that actively seek opportunities in the micro and small-cap equity markets.

Must Read OTC Markets/SEC policy on stock promotion and investor protection

Section 17(b) of the Securities Act of 1933 requires that any person that uses the mails to publish, give publicity to, or circulate any publication or communication that describes a security in return for consideration received or to be received directly or indirectly from an issuer, underwriter, or dealer, must fully disclose the type of consideration (i.e. cash, free trading stock, restricted stock, stock options, stock warrants) and the specific amount of the consideration. In connection therewith, EMC has received the following compensation and/or has an agreement to receive in the future certain compensation, as described below.

Disclaimer

EMC has been paid $500,000 by Volt Lithium Corp. EMC does not independently verify any of the content linked-to from this editorial. | Please read our full disclaimer.