SYMBOL: OTCQB: VLTLF; TSX-V: VLT; FSE: I2D

- Outstanding Shares: 137,362,757 (as of 06/30/2024)

- Float: 101,862,041 (as of 10/30/2023)

www.voltlithium.com

Focused on creating value for shareholders by becoming North America’s 1st commercial producer of lithium hydroxide & lithium carbonates from oilfield brine.

Volt Lithium Corp. (formerly Allied Copper Corp.) is pioneering a transformative approach to lithium extraction from oil field brine water, with recent successful pilot production demonstrating the commercial viability of their innovative IES-300 DLE technology.

Volt disrupts the traditional mining sector with their profitable processing of low-grade brines, challenging the prevailing “Grade is King” mantra. Volt’s strategy is to generate value for shareholders by leveraging management’s hydrocarbon experience and existing infrastructure to extract lithium deposits from existing wells, thereby reducing capital costs, lowering risks and supporting the world’s clean energy transition.

Innovative Development

With four differentiating pillars, Volt’s innovative approach to development positions the company for commercialization.

Proprietary

Extraction*

Stage 1 = Removes 99% of contaminants from lithium infused brine.

Stage 2 = DLE process extracts 93% of lithium from brine.

*Results in reduced capital costs.

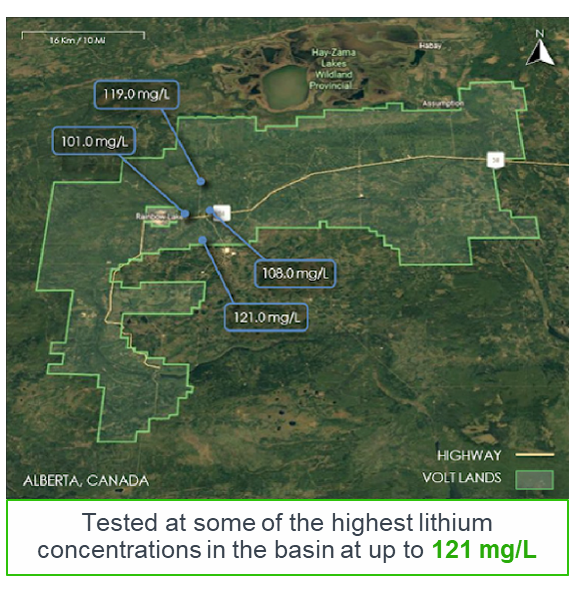

Lithium Production Agreement

- Agreement with oil producer, Cabot Energy.

- Cabot produces lithium infused brine today – no exploration needed.

- Management’s O&G background is key to project development.

Quality Lithium Reservoir

- Reservoir with 99B barrels of lithium infused brine.

- Highest lithium concentration tests in the basin = 121 mg/L.

- Veritable ‘ocean’ of brine provides long-term production.

- View Resources Report

Regulatory

Advantages

- No greenfield project approvals needed, a critical competitive advantage.

- Existing infrastructure and operations streamline Volt’s process.

Proprietary Technology

Volt’s proprietary Direct Lithium Extraction (“DLE”) technology is focused on allowing the highest lithium recoveries with lowest costs.

The company has successfully advanced from bench-scale testing to pilot production, achieving a lithium recovery rate of up to 90%. This validates the feasibility of their proprietary IES-300 DLE technology for commercial-scale operations. The extraction process has two unique steps, building seamlessly into existing oil and gas production infrastructure.

Step 1.

Brine Treatment

Proven system that eliminates up to 99% of contaminants from oilfield brines.

Step 2.

Proprietary DLE Technology

Proven system that eliminates up to 99% of contaminants from oilfield brines.Proprietary IES-300 technology recovers up to 93% of lithium from oilfield brines.

Seamless Integration

Volt’s pilot simulated commercial production and indicated Total Operating expenses of $2,900 USD per tonne [on their highest known concentrations of brine – 120 mg/L] for end to end production of LHM, which has a market value of roughly $48,000 USD per tonne.

These are economics derived from the pilot simulating commercial production – and it should be noted that it was not Volt’s aim in the initial stages of the pilot to optimize Operating expenses, but rather to demonstrate the commercial viability of their process in extracting lithium from oil field brines. Total Operating expenses estimates have the potential to come down even lower.

Market and Competitive Advantages

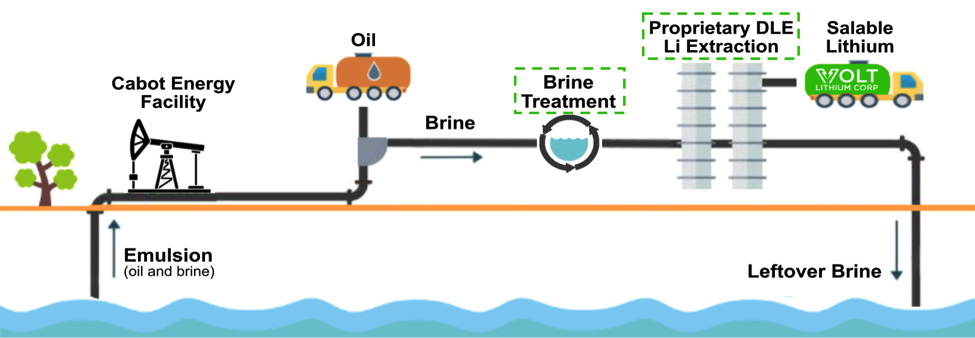

Unlike competitors such as E3 Lithium and Lithium Bank, Volt extracts lithium directly from the surface-pumped oilfield brine, maintaining competitive operating expenses despite lower lithium concentrations.

Volt’s business model employs rapidly deployable and scalable modular equipment, facilitating value extraction from low lithium concentration oilfield brines and opening avenues for mineral rights claims expansion.

Volt’s existing partnership with oil field operations ensures streamlined regulatory processes, enhancing the company’s appeal to investors and potential acquirers, with a projected valuation in the CAD $7-8 range by 2024. (EPS based on projections from independent analyst and industry writer, Mike Ballanger)

A crucial aspect of Volt’s story is its successful scaling operations. The transition from bench to pilot scale, a 400-fold increase in processing capacity, has been a major achievement, greatly de-risking the project. The next step, the move from pilot to commercial production, involves a mere 5-fold increase. Given the success in the previous scaling operation, this transition appears promising.

Furthermore, Volt is positioned to move to production quickly due to its strategic partnerships with companies already bringing brine to surface. This approach allows Volt to share operating costs and extract valuable mineral resources, adding value to the operations of its partners.

Volt's successful pilot production economically validates their operations, with projections indicating considerable margins due to high lithium trade rates compared to Volt's operational expenditure, and expected production growth from 1000 tonnes to 20k tonnes within three years.

- James Painter, EMC Founder/Market Analyst

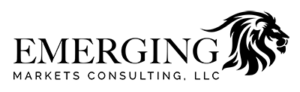

Volt’s world class lithium land base is located in the Rainbow Lake area in Alberta, Canada.

in the basin at top 121 mg/L.

Strategic Facilities & Infrastructure

Through partnership with Cabot Energy, Volt significantly reduces their capital expenditure and prolongs oil wells’ economic viability by sharing existing oilfield infrastructure, thereby reducing operational costs for oil field operators.

World-Class Lithium Land Base

Rainbow Lake Pilot

The area features significant existing production infrastructure and wells, providing considerable opportunity for the application of Volt’s lithium extraction technology. Optimal lithium concentrations are being evaluated across the land base to maximize revenue potential, with wells being tested at some of the highest concentrations in the basin at up to 121 mg/L.

Expansive Land Base

~435,000 Acres of Land

Production Infrastructure

>1,300 Producing Wells

Lithium Concentrates

121mg/L Li Concentrations

High Output Capabilities

99B Barrels of Li Infused Brine

Developing battery metals for a greener tomorrow

Volt Lithium – Realizing its Commitment to Bring Necessary Green Energy Resource Assets Into Production in the Very Near Term

Volt is committed to sourcing assets that can be taken into production near term, leveraging the experience of Executive Chairman Warner Uhl’s decades of experience in mining operations and equipment sourcing. This mandate made a union with Volt Lithium a very natural progression for the company.

Volt wants to emphasize the proprietary technology, the elimination of exploration risk, the infrastructure already in place and the sheer size of the asset in its possession.

- Volt aims to be North America’s first commercial producer of lithium from a brine going into pilot production by the end of Q1 2023.

- Massive lithium reservoir with 99 Billion Barrels of lithium-infused brine, concentrations up to 121 mg/L, yielding asset production life-cycle of 100+ years.

- Economical and economically insulated, with a projected cost of production a fraction of market value.

- Comparable in size and stage of development to companies like E3 Metals and LithiumBank but with a marketcap a fraction of the size.

- Proprietary Direct Lithium Extraction (DLE) technology provides high recoveries at low costs, making it a valuable IP asset and competitive advantage over other Li Brine assets outsourcing this technology.

- Infrastructure already in place, eliminating exploration risk and greenfield approvals, piggybacks on existing infrastructure, positioning the company to meet increasing demand for lithium.

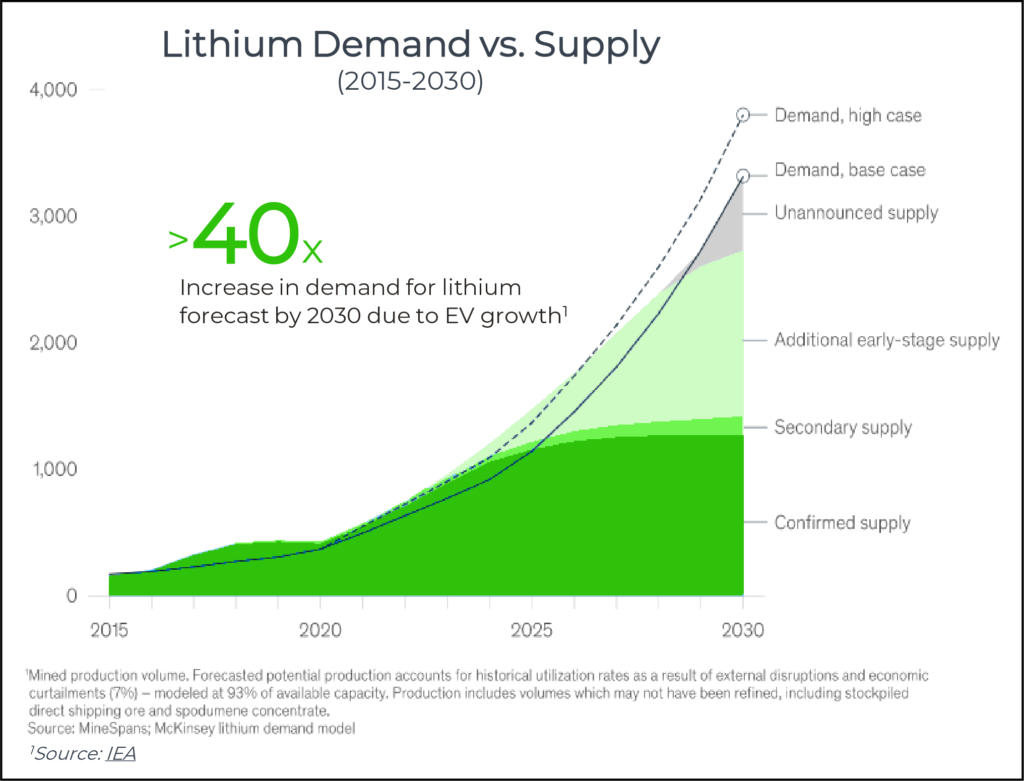

Supportive Lithium Market

Demand shows no signs of slowing, while confirmed lithium supply is flat

- Demand for lithium is rising as electric vehicles and renewable energy continue to gain ground

- Market faces insufficient lithium supply to meet demand for expanding EV revolution

- The most critical inputs in race to electrify the globe are lithium, copper and graphite

Recent News

- Volt Lithium Achieves Significant Operational Milestone with the Scale-Up of its Field Unit to 96,000 Litres Per Day, Paving the Way for Operations to Commence in Q3 2024 – July 17, 2024

- Volt Lithium to Participate in Live Webinar on June 25 – June 24, 2024

- Volt Lithium Announces Expansion of Team to Facilitate Growth to Field Operations – June 13, 2024

- Volt Lithium Announces Closing of US$1.5 Million Strategic Investment – May 2, 2024

- Volt Lithium Announces US$1.5 Million Strategic Investment to Commence Field Operations in the Delaware Basin in Texas, USA – April 29, 2024

- Volt Lithium Reduces Operating Costs By 64%, Achieving Operational Milestone – February 21, 2024

- Volt Lithium Announces Successful Production of Battery-Grade Lithium Carbonate at the Company’s Permanent Demonstration Plant in Calgary, Alberta – January 31, 2024

- Volt Lithium Highlights Major 2023 Operational Milestones and Provides Outlook for 2024 – January 25, 2024

- Volt Lithium Announces Preliminary Economic Assessment at Rainbow Lake Project in Alberta, Highlighted by 45% IRR and US$1.5 Billion Before-Tax NPV8 – December 14, 2023

- Volt Lithium Announces Expanded Capabilities Beyond Rainbow Lake Enabling Oilfield Brine Processing From Across North America – October 24, 2023

- Volt Lithium Announces Participation in Two Upcoming Investor Conferences in October – October 11, 2023

- Volt Lithium Announces Appointment of New Board Chair – September 6, 2023

- Volt Lithium Announces Transition to Pure-play Lithium Developer With Termination of Option Agreements for Copper Assets – August 17, 2023

- Volt Lithium Announces Filing of Prospectus Supplement in Respect of $6 Million Marketed Public Offering of Units and Announces $1.2 Million Concurrent Private Placement of Units – July 28, 2023

- Volt Lithium Corp. Receives Receipt for Final Short Form Base Shelf Prospectus – July 21, 2023

- Volt Lithium Corp. Announces Strategic Collaborations with Nanotechnology Labs to Accelerate North American Lithium Production & Environmentally Conscious Water Management – July 13, 2023

- Volt Lithium Corp. Files Preliminary Short Form Base Shelf Prospectus – July 11, 2023

- Volt Lithium Corp. Announces Successful Pilot Project, Confirming 90% Lithium Recovery, Commercial Economics and Unprecedented Breakthrough – May 24, 2023

- Volt Lithium Corp. Announces Resource Report Indicating 4.3 Million Tonnes of Lithium Resource at its Rainbow Lake Property with Concentrations Up to 121 mg/L – May 18, 2023

- Volt Announces Extension to Agreement with Emerging Markets Consulting, LLC – May 5, 2023

- Volt Lithium Corp. Announces Management Change and Begins Trading on the TSX Venture Exchange Under the Stock Ticker Symbol “VLT” – April 27, 2023

- Allied Copper Announces 99.9% Shareholder Approval for Name Change to Volt Lithium Corp. and Election of Additional Board Member – April 21, 2023

- News Release for Early Warning Report Regarding Allied Copper Corp. – April 10, 2023

- Volt Lithium Announces Technical Breakthrough With Next-Generation IES-300 Proprietary Direct Lithium Extraction Process – April 6, 2023

- Allied Copper Announces Renewed Agreement With Emerging Markets Consulting, LLC – April 3, 2023

- Volt Lithium Meets Key Milestone With Start-up of Pilot Project – March 30, 2023

- Allied Copper Announces Option Grant – March 24, 2023

- Allied Copper Announces Proposed Name Change to Volt Lithium Corp, Addition of New Board Member and Voluntary Lock-up Agreements With Former Volt Shareholders – March 22, 2023

- Allied Copper Increases Non-Brokered Financing From $2,000,000 To $4,000,000 – February 10, 2023

- Allied Copper Announces Termination of Klondike Option Agreement – February 2, 2023

- Allied Copper Announces $2.0 Million Non-Brokered Financing – January 30, 2023

- Volt Lithium Announces 93% Lithium Recoveries From Its Proprietary DLE Technology – January 24, 2023

- Allied Copper Announces Corporate Update Including Lithium Concentrations Up to 91 mg/L in Volt’s Latest Field Activities – January 19, 2023

- Allied Copper Appoints Additional Director and Grants Stock Options – December 19, 2022

- Allied Copper Completes the Acquisition of Volt Lithium Corp. – December 9, 2022

- Allied Copper Intersects 4.26% Copper Over 1.06 Metres at West Graben Fault Target in Colorado – November 30, 2022

- Allied Copper Reports Additional Financial and Technical Information for Volt Lithium Corp. – November 24, 2022

- Allied Copper Enters Into Agreement to Acquire Volt Lithium Corp. – October 31, 2022

- Allied Copper Receives TSX-V Approval for Stateline Option Agreement – September 26, 2022

Emerging Markets Report

- Amplifying North American Lithium Production – July 17, 2023

- The Revolutionary Impact of Direct Lithium Extraction on the Burgeoning EV Market – June 21, 2023

- A Revolution Inside a Revolution – June 6, 2023

- Hard Work Pays Off – May 25, 2023

- Company Transformations Pave the Way for Lithium Production – May 10, 2023

- Breakthrough – April 14, 2023

- Technology is Key – April 5, 2023

- Supply and Demand – February 28, 2023

- A Better Mousetrap – January 26, 2023

Must Read OTC Markets/SEC policy on stock promotion and investor protection

Disclaimer

EMC has been paid $500,000 by Volt Lithium Corp. | Please read our full disclaimer

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact