Atmofizer Technologies Inc.

(CSE: ATMO; OTCQB: ATMFF)

The Power of the Patent | 05/10/2022 |

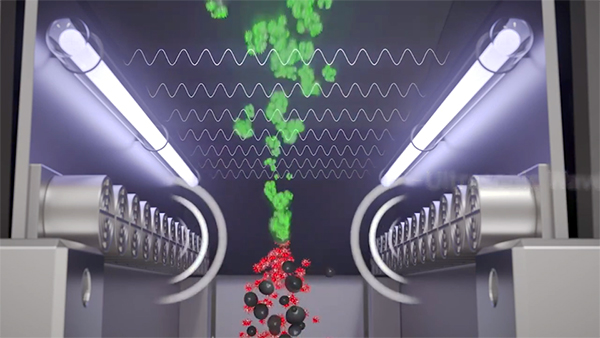

A report last month that the United States Patent and Trademark Office (the “USPTO”) has issued a patent related to ATMOFIZER TECHNOLOGIES INC.’s (CSE: ATMO; OTCQB: ATMFF) air and water purification technology is a significant milestone for the Company. Specifically, the issued patent, titled, “Ultra-Fine Particle Aggregation, Neutralization and Filtration” (US Patent Application No. 17/471,610) provides broad protection for the application of the Company’s air and water purification technology in the United States.

We think it is impactful insofar as it demonstrates the Company’s novel approach to cleaning the air is and it protects the commercial use of this technology in the United States as the Company continues to execute its business plan.

Let’s back up for a moment and make sure that anyone new to the Atmofizer story understands what’s in play here.

Atmofizer has licensed a proprietary technology which allows it to more efficiently clean air by killing pathogens. The method is remarkable. It also goes without saying that the COVID-19 pandemic has raised awareness and interest in a cleaner, safer world.

Atmofizer’s CEO, Olivier Centner states:

“This US patent provides protection for our intellectual property and further validation of our novel approach to air purification technology and enables Atmofizer to confidently pursue further development of its technology. This patent is a critical step in protecting our technology and establishing ourselves as the leaders in purifying air from even the smallest ultra-fine particles. COVID-19 has raised awareness of the importance of indoor air quality and the dangers posed by ultra-fine particles and the market is growing exponentially.”

Atmofizer’s Patent Attorney states:

“The importance of this issued patent for Atmofizer is that the patent covers Atmofizer’s current commercial embodiment of its flagship air purifier,” said Atmofizer Patent Attorney, Joel Weiss. “The innovations claimed in the issued patent represent important steps forward in providing clean and comfortable air in today’s confined living spaces.”

He’s right. By obtaining the patent Atmofizer can pursue the commercial space for their unique and potentially market disruptive flagship air purifier. That is what this patent ignites.

If you’re a believer in Atmofizer then this news should give you some comfort that the tech is patent protected.

That’s the power of a patent.

About The Emerging Markets Report:

The Emerging Markets Report is owned and operated by Emerging Markets Consulting (“EMC”), a syndicate of investor relations consultants representing years of experience. Our network consists of stockbrokers, investment bankers, fund managers, and institutions that actively seek opportunities in the micro and small-cap equity markets.

Must Read OTC Markets/SEC policy on stock promotion and investor protection

Section 17(b) of the Securities Act of 1933 requires that any person that uses the mails to publish, give publicity to, or circulate any publication or communication that describes a security in return for consideration received or to be received directly or indirectly from an issuer, underwriter, or dealer, must fully disclose the type of consideration (i.e. cash, free trading stock, restricted stock, stock options, stock warrants) and the specific amount of the consideration. In connection therewith, EMC has received the following compensation and/or has an agreement to receive in the future certain compensation, as described below.

Disclaimer

EMC has been paid US$525,000 by Atmofizer Technologies Inc. for various marketing services including this report. EMC does not independently verify any of the content linked-to from this editorial. | Please read our full disclaimer

ADDITIONAL DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Emerging Markets Consulting, LLC, and their owners, managers, employees, and assigns (collectively “EMC”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Atmofizer Technologies Inc. (“Atmofizer”) US$525,000 for this profile. This compensation is a major conflict with our ability to be unbiased, more specifically:

- This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Atmofizer to conduct investor awareness advertising and marketing for Atmofizer. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of Atmofizer Technologies Inc. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

- We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public and non-public sources but is not researched or verified in any way whatsoever to ensure the information is correct.

SHARE OWNERSHIP. The owner of EMC may own shares and/or stock options of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of EMC will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of EMC will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. EMC is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to buy or sell securities.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact