MAX Power’s leadership team roster

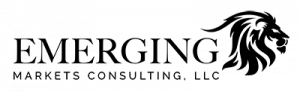

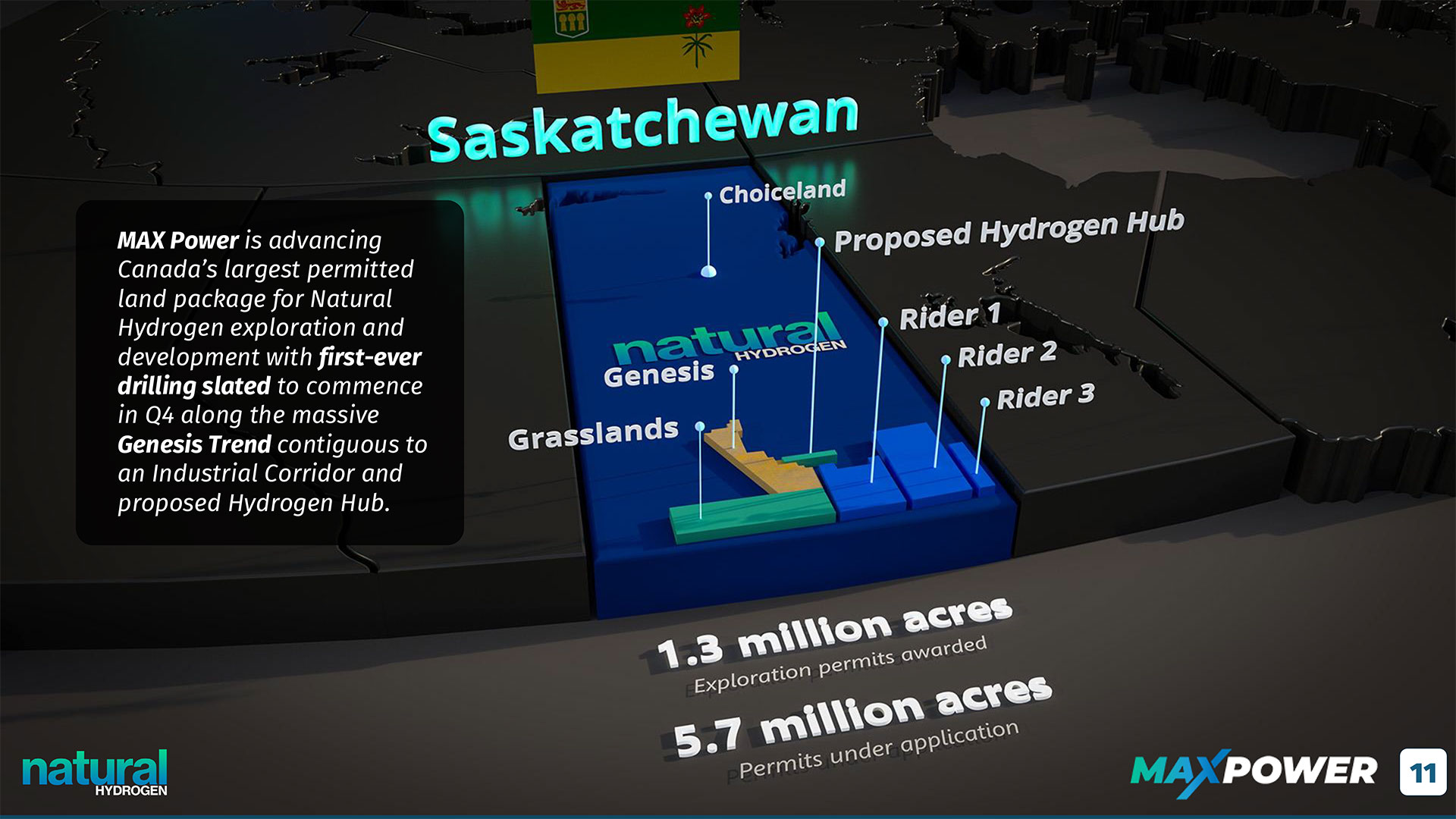

Former Cameco Chairman Neil McMillan orchestrated a $337 million mining buyout. CEO Ran Narayanasamy spent 17 years at SaskPower before leading a globally recognized research center. Their technical advisor helped discover the world’s first commercial Natural Hydrogen deposit. This isn’t a startup team—it’s a proven crew with the connections, credentials, and track record to turn Canada’s largest hydrogen land package into reality. Review the corporate presentation and learn the details you need to understand why MAX Power, and why now.