Atmofizer Technologies Inc.

(CSE: ATMO; OTCQB: ATMFF)

The Mother of Invention | 04/06/2022 |

Atmofizer’s Technology Makes Virus Particles Larger, Easier to Kill

We are pleased today to introduce a new featured company, and one with its own proprietary technology in which the United States Patent Office issued a patent related to the Company’s air and water purification system that provides consumer and industrial solutions for the times we live in and beyond. Seismic events, like the COVID-19 outbreak, are often massive changes agents. Long after the cases and hospitalizations abate, a new desire for the world to be cleaner and safer will likely prevail.

If you also believe that we will as a society take the safety of the air we breathe much more seriously, then today’s featured company warrants review.

ATMOFIZER TECHNOLOGIES INC. (CSE: ATMO; OTCQB: ATMFF) offers consumer and industrial solutions based on its patent-protected and patent pending technology for ultrafine particle agglomeration and neutralization. This capability creates a revolutionary and more efficient method for addressing the wide range of dangerous nano-scale particles, viruses and bacteria that are too small to be effectively managed by conventional filters and ultraviolet lights. Atmofizer plans to disrupt the air treatment industry by improving air safety against industrial pollution, smoke, and airborne infectious diseases — while providing the additional benefits of increasing air purification efficiency, lowering customers’ operational costs and negative impacts on the environment.

Atmofizer has launched its initial device designed to prove the concept and join the immediate fight against COVID and air pollution, backed by internal and independent third-party data and testing showing nanoparticle agglomeration and reduction of virus and bacteria. Atmofizer is focused on licensing its intellectual property to major appliance, HVAC, automotive, and medical device manufacturers to integrate into their respective products and distribution networks.

I had to look up what “agglomeration” meant too, but in doing so I got a better handle on the true efficacy of Atmofizer’s unique process and product offering.

Agglomeration is “a mass or collection of things; an assemblage.” Agglomeration is what is special about what Atmofizer is doing.

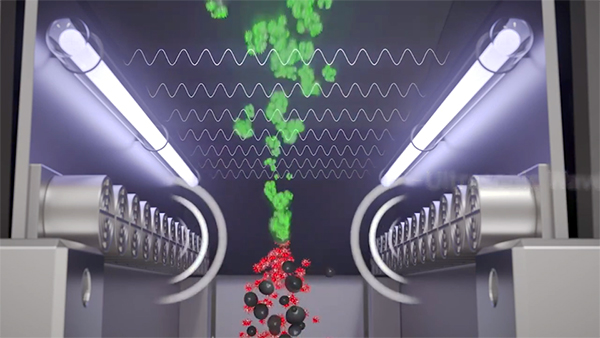

Atmofizer is clustering together particles in the air that can be too small to be addressed individually and then disposing of them in an “agglomeration.” As Atmofizer explains in this video which describes the tech quite clearly, Atmofizer’s proprietary, disruptive new technology uses a revolutionary application of sound and light to neutralize dangerous and elusive nano-scale airborne particles, viruses, and bacteria too small to be efficiently destroyed by conventional filters and ultraviolet lights.

In that video there is a compelling moment where the speaker declares that filters cannot be made smaller (and still be able to efficiently process air) so the solution requires a change from the old paradigm — the improvement comes from making the particles bigger so they are more easily filtered or fall harmlessly to the ground and out of the breathing space; the increased mass also enables the particles to become more susceptible to being more extensively neutralized by UV light. This is what is new and novel about Atmofizer, which has created a patented component to neutralize harmful elements in the air at a time when we need and want it most.

As the Greek philosopher Plato once said, “Necessity is the mother of invention.”

For society, a two year pandemic is assuredly the mother and a new way at looking at cleaning the air around us from Atmofizer could be the invention.

About The Emerging Markets Report:

The Emerging Markets Report is owned and operated by Emerging Markets Consulting (“EMC”), a syndicate of investor relations consultants representing years of experience. Our network consists of stockbrokers, investment bankers, fund managers, and institutions that actively seek opportunities in the micro and small-cap equity markets.

Must Read OTC Markets/SEC policy on stock promotion and investor protection

Section 17(b) of the Securities Act of 1933 requires that any person that uses the mails to publish, give publicity to, or circulate any publication or communication that describes a security in return for consideration received or to be received directly or indirectly from an issuer, underwriter, or dealer, must fully disclose the type of consideration (i.e. cash, free trading stock, restricted stock, stock options, stock warrants) and the specific amount of the consideration. In connection therewith, EMC has received the following compensation and/or has an agreement to receive in the future certain compensation, as described below.

Disclaimer

EMC has been paid US$300,000 by Atmofizer Technologies Inc. for various marketing services including this report. EMC does not independently verify any of the content linked-to from this editorial. | Please read our full disclaimer

ADDITIONAL DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Emerging Markets Consulting, LLC, and their owners, managers, employees, and assigns (collectively “EMC”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Atmofizer Technologies Inc. (“Atmofizer”) US$300,000 for this profile. This compensation is a major conflict with our ability to be unbiased, more specifically:

- This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Atmofizer to conduct investor awareness advertising and marketing for Atmofizer. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of Atmofizer Technologies Inc. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

- We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public and non-public sources but is not researched or verified in any way whatsoever to ensure the information is correct.

SHARE OWNERSHIP. The owner of EMC may own shares and/or stock options of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of EMC will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of EMC will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. EMC is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to buy or sell securities.