INTELLISTAKE TECHNOLOGIES CORP.

The Intersection of Blockchain and AI

Disseminated on behalf of Intellistake Technologies Corp.

Crypto and AI are converging—Intellistake is helping to reshape crypto investing.

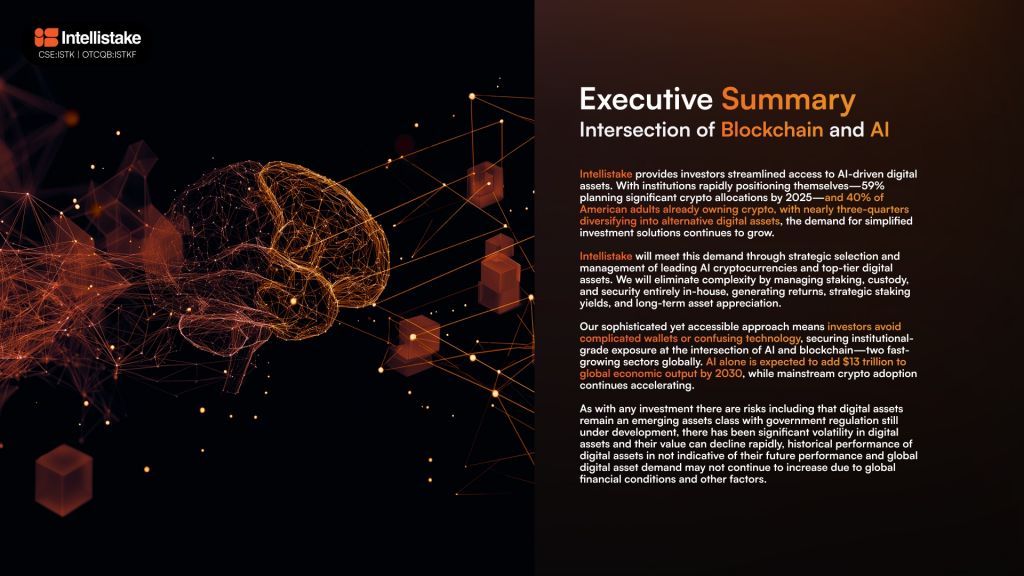

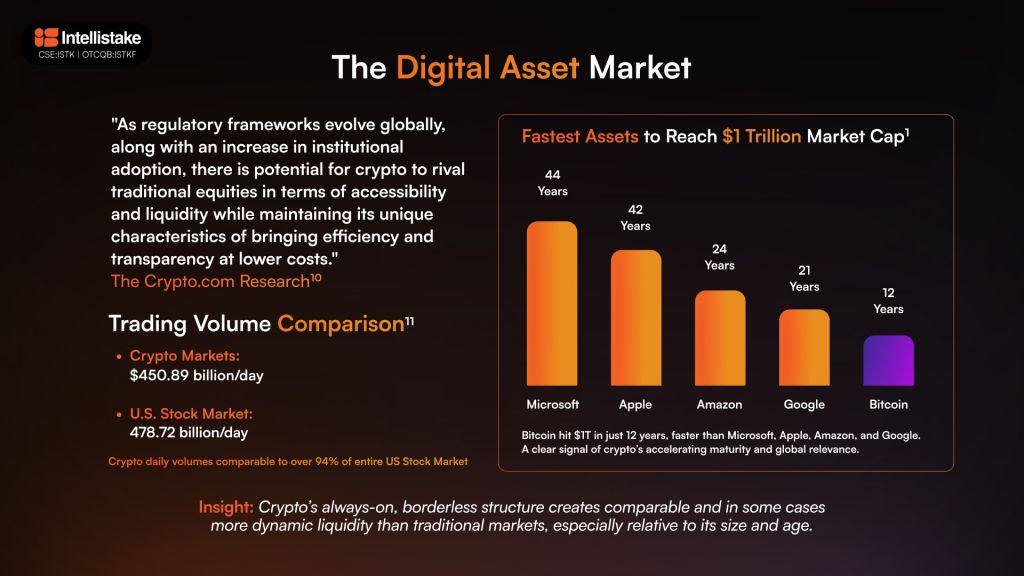

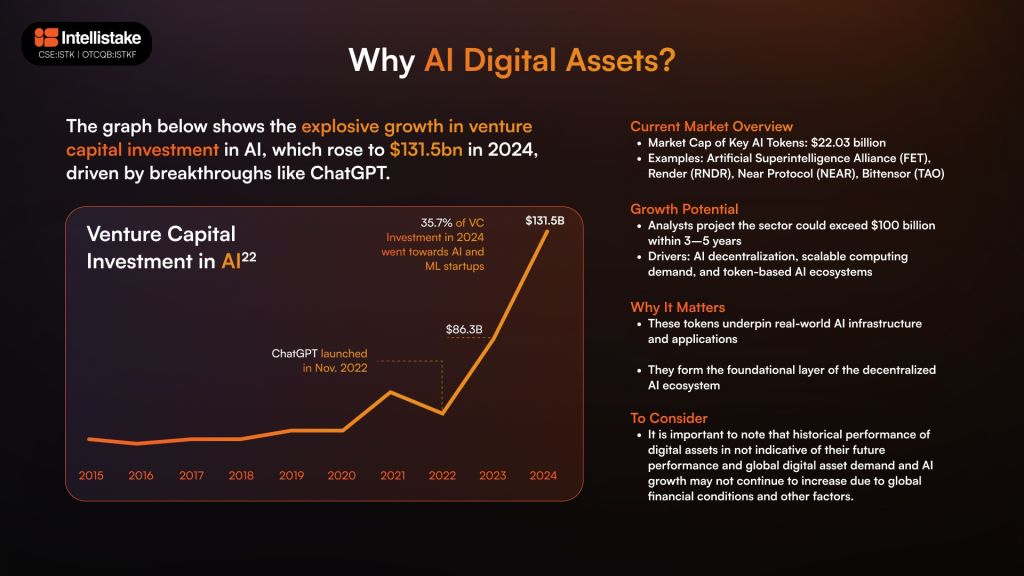

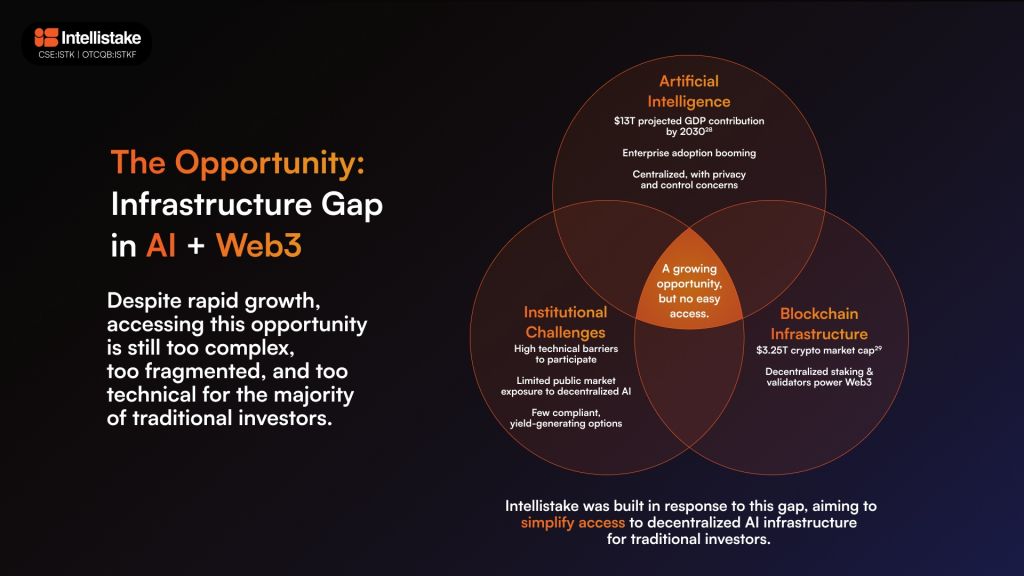

The barriers are real: complex wallets, private key management, volatile exchanges, and a learning curve that intimidates even sophisticated investors. Meanwhile, the opportunity keeps growing. The crypto market has surpassed $3 trillion. AI-focused digital assets now command a $22 billion market cap.

We provide traditional investors with regulated, stock-exchange access to high-growth blockchain and AI opportunities—without the complexity of direct token management. Buy shares through your existing brokerage. That’s it. No wallets. No seed phrases. No navigating DeFi protocols.

As an early stage development company, we serve investors who recognize where technology is heading but don’t want to become crypto experts overnight, Intellistake offers a familiar path into an unfamiliar frontier.

Our Market Approach: Strategic, Sustainable, Scalable.

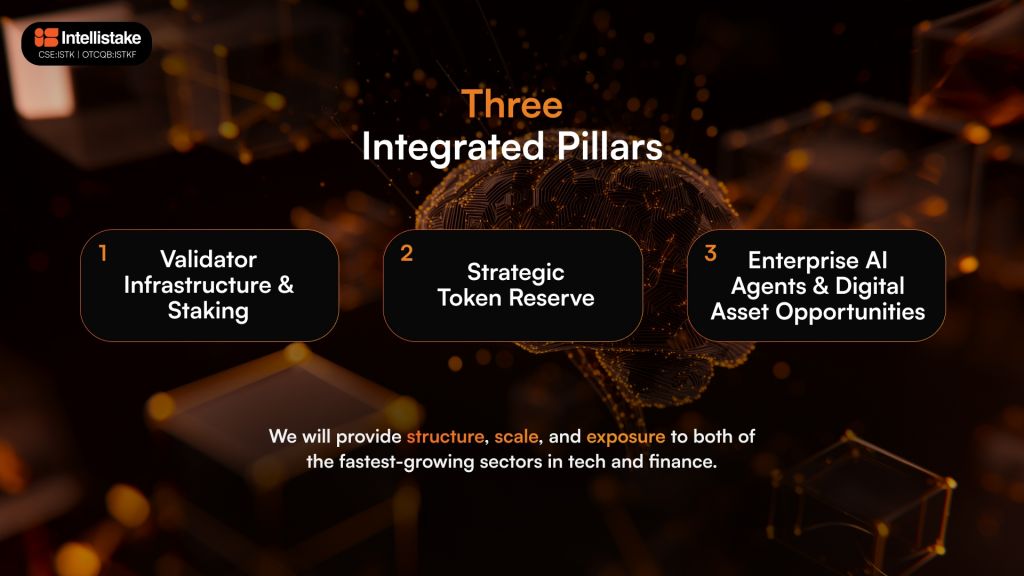

Three Ways We Aim to Generate Returns

Validator Operations

We run *blockchain validator nodes that help secure AI-focused networks and earn staking rewards—while supporting the infrastructure of tomorrow.

Digital Asset Portfolio

We hold a curated portfolio of AI-related tokens, strategically selected for their role in decentralized AI ecosystems. Professional management without you touching a wallet.

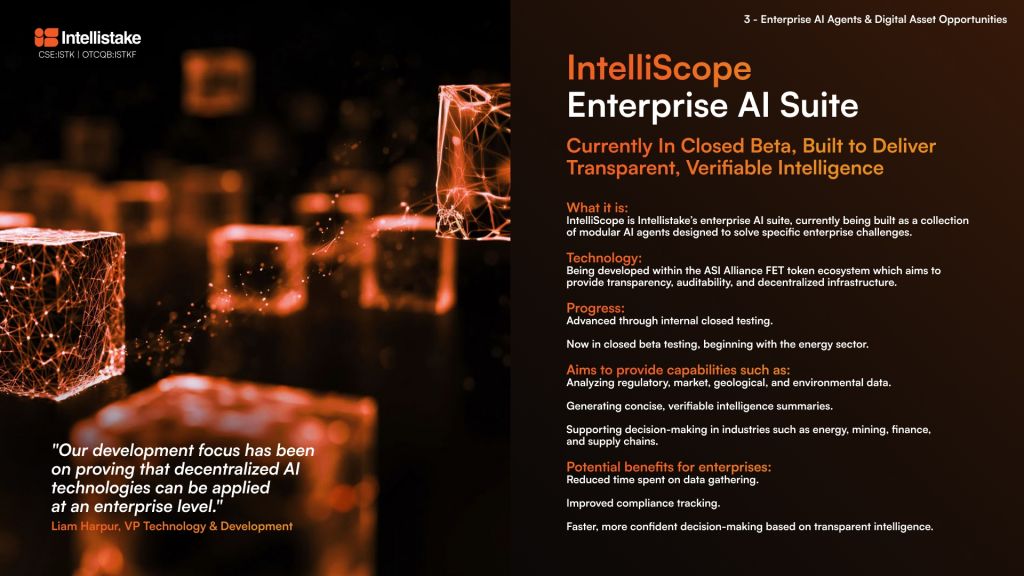

AI Software Solutions

We’re developing enterprise **AI agents for industries like energy, mining, and logistics— once commercialized these are intends to generate recurring subscription revenue through real-world business applications.

*Blockchain validator nodes are computers on a blockchain network that verify transactions and propose or confirm new blocks, following consensus rules. They help secure the network and may earn rewards for honest participation.

**An AI agent is software that can plan, decide, and take actions to complete tasks autonomously, using models, tools, and data—often coordinating steps, calling APIs, and adapting to results and user goals.

Intellistake gives you regulated, stock-market access to the fastest-growing technology sectors—no crypto wallets, no private keys, no technical headaches.

The Challenge for Investors

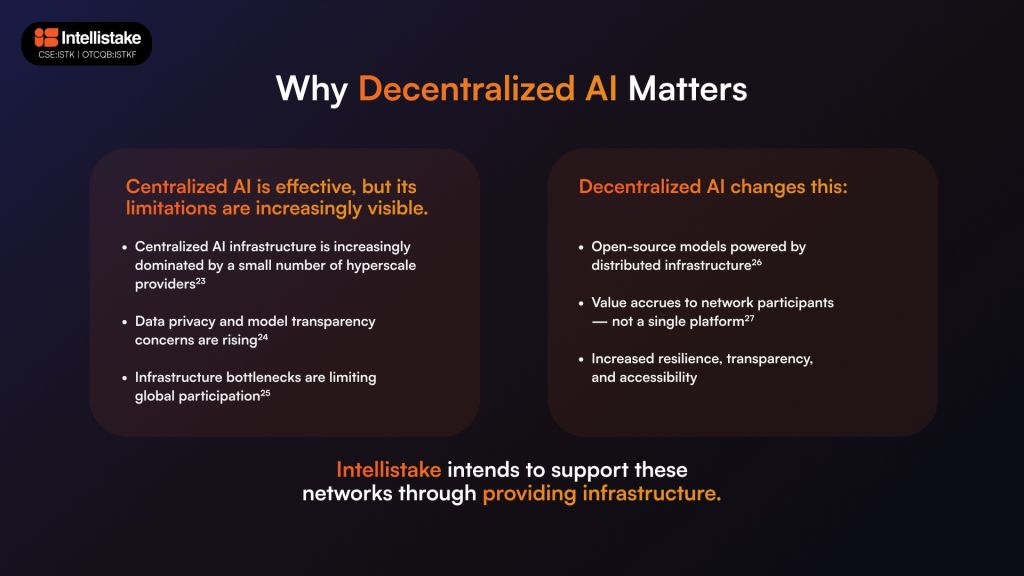

- Retail investors today have several barriers in accessing investments in cryptocurrency and decentralized AI because these cutting-edge sectors remain challenging to navigate.

- Traditional investing platforms offer limited access to regulated crypto opportunities, while blockchain’s complexity and technical barriers intimidate new entrants.

- Additionally, the perceived volatility and regulatory uncertainty surrounding crypto often discourage cautious investors, leaving them sidelined from some of the decade’s fastest-growing investment opportunities.

How Intellistake Solves This

Intellistake provides a simplified, regulated gateway for traditional investors to tap into high-growth crypto and blockchain opportunities without the complexity and risk of direct digital token management.

As a publicly traded entity, Intellistake will offer professionally managed blockchain infrastructure and strategically diversified token holdings —simplifying investor participation, and ensuring stable, compliant exposure to fast-growing blockchain and decentralized AI markets. Noting crypto markets have been volatile and past performance does not indicate future performance.

Simple & Straightforward

How It Works

Buy Shares Like Any Stock

We Manage the Technology

You Get the Exposure

Why This Matters Now

AI and blockchain aren’t future technologies anymore—they’re here. Major corporations are adding digital assets to their balance sheets. Institutions are building the infrastructure. The question isn’t if these technologies will reshape finance—it’s whether you’ll be positioned when they do.

Featured Videos

3:11

6:40

6:29

5:16

6:17

5:06

Intellistake Leadership & Advisors

Recent News

- Intellistake Technologies Corp. Appoints Founding Member of Revolut’s Crypto Team to Advisory Board – January 20, 2026

- Intellistake Technologies Corp. Signs Definitive Agreement to Acquire Premier AI-Web3 Venture Accelerator Singularity Venture Hub – December 24, 2025

- Intellistake Technologies Corp. Appoints Dr. Ben Goertzel, Leading Artificial Intelligence Researcher and SingularityNET Founder, to Advisory Board as a Special Advisor to the CEO to Advance Decentralized AI Integration December 17, 2025

- Intellistake Completes US$500,000 Investment in Orbit AI and Orbit AI Concludes Following Successful First Orbital Cloud Launch – Decemnber 11, 2025

- $2.17 Million in Proceeds Received by Intellistake from Warrant Exercises – December 10, 2025

Must Read OTC Markets/SEC policy on stock promotion and investor protection

COMPENSATION DISCLOSURE

EMC has been retained by Think Ink Marketing on behalf of Intellistake and paid $275,000. | Please read our full disclaimer

Forward-Looking Disclaimer

Intellistake is reliant on Orbit AI for the financing and technical execution of the planned satellite launches. Intellistake’s involvement is limited to providing the validator and node infrastructure. The amount of any future revenues or benefits that may accrue to Intellistake has not yet been determined.

Completion of the acquisition of Singularity Venture Hub (SVH) remains subject to completion of satisfactory due diligence, the negotiation and execution of a definitive agreement (“Definitive Agreement”) that will include representations, warranties, covenants, indemnities, termination rights, and other provisions customary for a transaction of this nature, no objection from the Canadian Securities Exchange, and shareholder approval of SVH, if required.

Intellistake recently commenced operating its blockchain business and is at an early stage of development. Intellistake is entering this space by acquiring and operating blockchain validator hardware that supports AI networks and investing in AI-related digital tokens to primarily operate validator hardware.

Intellistake plans to create custom AI software systems called “AI Agents” for businesses. These are intelligent software programs that can perform specific tasks automatically. For example, an AI Agent might help a travel company by automatically booking flights and hotels when a customer provides their preferences and budget. The Agent would search available options, compare prices, and make reservations without human intervention.

The company intends to deliver these solutions either as one-time projects or ongoing subscription services. Future revenue will be generated from implementation fees and monthly subscription payments. The company has not yet developed these AI Agents and does not presently have any customers. Intellistake is just commencing operations. It is targeting significant growth but its business is subject to several risks related to general business, economic and social uncertainties; the sufficiency of cash to meet liquidity needs; legislative, political and competitive developments; the inherent risks involved in the digital currency and general securities markets; the volatility of digital currency prices and the additional risks identified in the “Risk Factors” section of the company’s filings with applicable securities regulators. Intellistake has not yet developed or commercialized its AI solutions.

This report contains “forward-looking information” concerning anticipated developments and events related to the company that may occur in the future. Forward looking information contained in this report includes, but is not limited to, all statements in respect of the company’s growth and development, the operations and business segments of the company, support for decentralized AI and blockchain networks, the details of the collaboration with Orbit AI and its expected benefits; the company’s contributions towards the collaboration with Orbit AI; the timelines for Orbit AI’s operation; the development of and commercialization of software solutions; expectations for future revenues and Intellistake’s strategy to support tokenized, decentralized AI infrastructure.

In certain cases, forward-looking information can be identified by the use of words such as “expects”, “intends”, “anticipates” or variations of such words and phrases or state that certain actions, events or results “may”, “would”, or “might” suggesting future outcomes, or other expectations, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this report is based on certain assumptions regarding, among other things, the company and Singularity Venture Hub (“SVH”) are satisfied with their respective due diligence; the company and SVH enter into a definitive agreement for the transaction; the company and SVH satisfy all conditions necessary to close the proposed transaction; the company will continue to have access to financing until it achieves profitability; the company is able to raise sufficient financing to complete the announced investment into Orbit AI; obtaining the necessary regulatory approvals; the technology and blockchain industries in which the company intends to focus its business in will grow at the rate and in the manner expected; the ability to attract qualified personnel; the success of market initiatives and the ability to grow brand awareness; the ability to distribute company’s services; the company creates strategies to mitigate risks associated with cryptocurrency price fluctuations; the company and SVH remain compliant with all applicable laws and securities regulations and applicable licensing requirements; the company engages and collaborates with local experts, as necessary, to address jurisdiction-specific matters and ensures compliance with foreign regulations to avoid penalties; the company addresses any potential cybersecurity threats promptly and effectively; the ability of the company to develop its technology, acquire customers and have revenue; the ability to successfully deploy the new business strategy as a result of the change of business. While the company considers these assumptions to be reasonable, they may be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from any future results expressed by the forward-looking information. Such factors include risks related to general business, economic and social uncertainties; the company fails to raise sufficient financing to complete the announced investment into Orbit AI; Orbit AI is unable to raise sufficient financing to complete its launch of satellites on the timelines proposed or at all; technical risks associated with Orbit AI’s planned operations; failure of the company and SVH enter into a definitive agreement for the transaction; failure of the company and SVH to satisfy all conditions necessary to close the proposed transaction; failure to raise the capital necessary to fund its operations; inability to create strategies to mitigate the risks associated with cryptocurrency price fluctuations; the costs of regulation in the digital asset industries increase to the extent that the company is no longer generating sufficient returns for shareholders; failure to promptly and effectively address cybersecurity threats; insufficient resources to maintain its operations on a competitive basis; and the actual costs, timing and future plans differs expectations; legislative, environmental and other judicial, regulatory, political and competitive developments; the inherent risks involved in the cryptocurrency and general securities markets; the company may not be able to profitably liquidate its current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on the company’s operations; the company’s success may depend on the continued involvement of key personnel, including advisors, whose involvement cannot be guaranteed; institutional adoption of decentralized AI infrastructure remains uncertain and may not occur at the pace or scale anticipated; evolving regulatory frameworks, including those related to AI (such as Canada’s proposed Artificial Intelligence and Data Act), may impose additional compliance burdens or restrict certain business activities; valuation figures are based on publicly available market data and internal assessments at the time of the referenced transactions and may not reflect current or future valuations; the volatility of digital currency prices; the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, currency fluctuations; regulatory restrictions, liability, competition, loss of key employees and other related risks and uncertainties; delay or failure to receive regulatory approvals; failure to attract qualified personnel, labour disputes; and the additional risks identified in the “Risk Factors” section of the company’s filings with applicable Canadian securities regulators.

Although the company has attempted to identify factors that could cause actual results to differ materially from those described in forward-looking information, there may be other factors that cause results not to be as anticipated. Readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this report. Except as required by applicable securities laws, the company does not undertake any obligation to publicly update forward-looking information.