SYMBOL: TSX-V: TIGR

- Outstanding Shares: 97,099,000

- Website: TigerGoldco.com

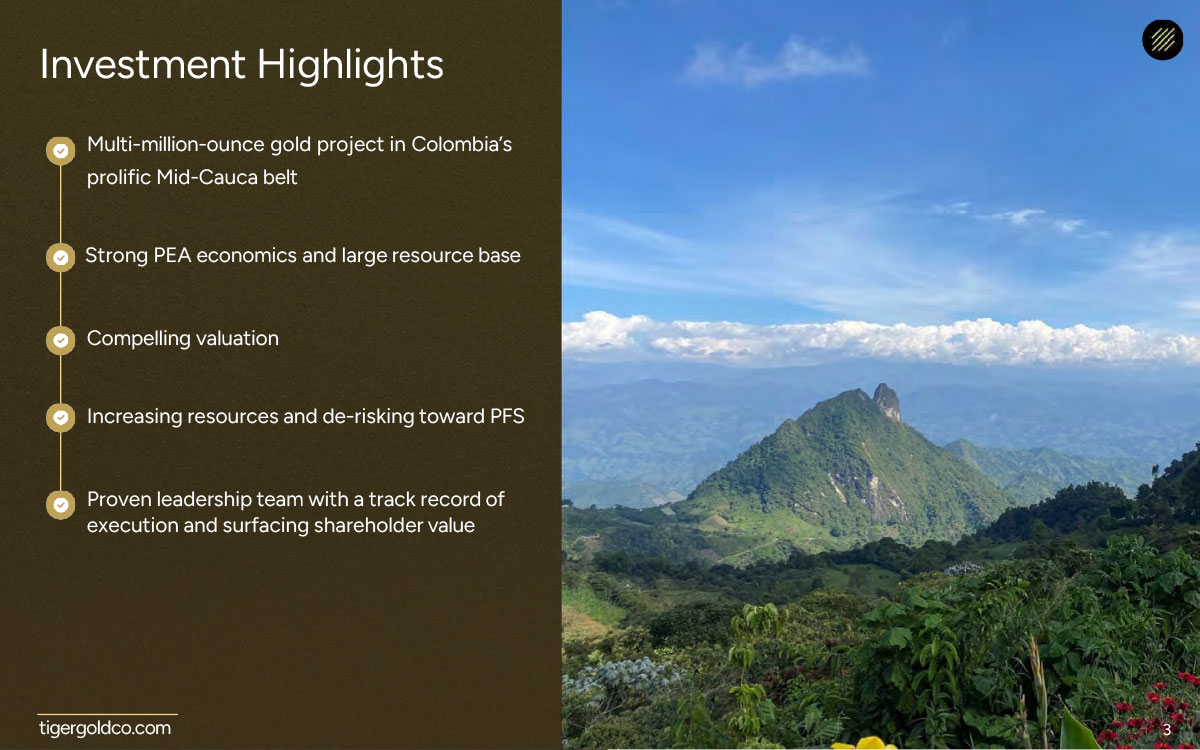

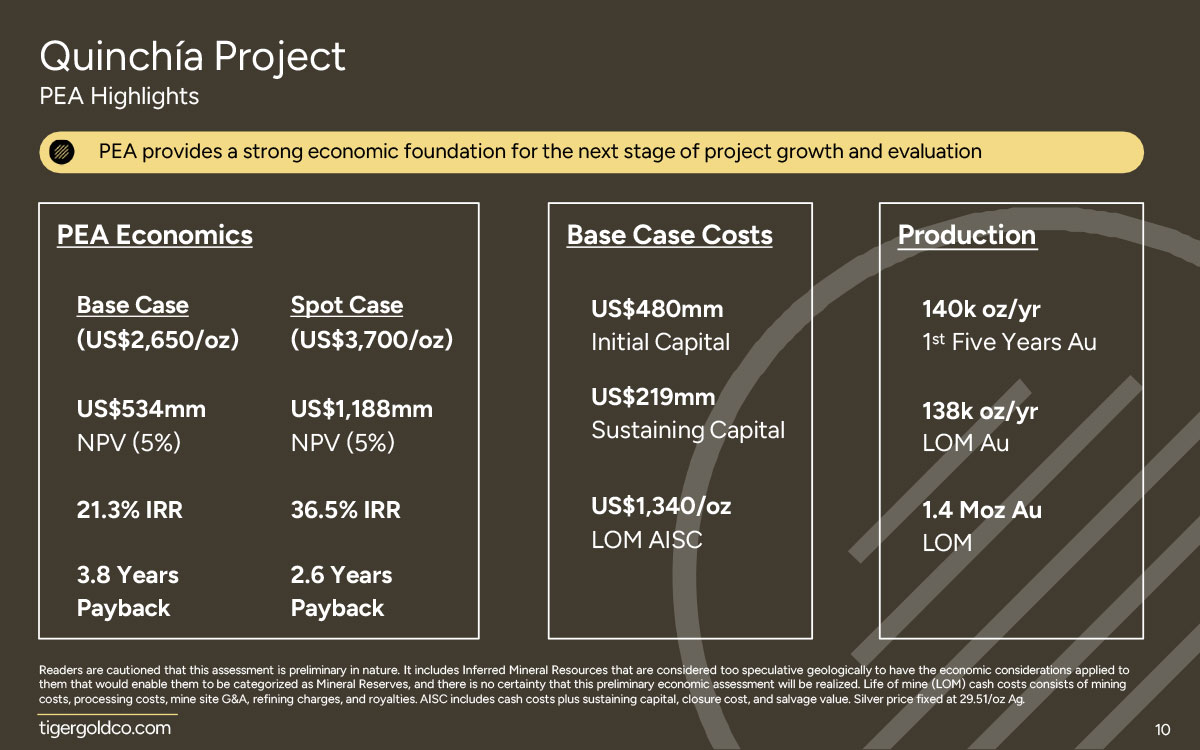

Tiger Gold Corp is advancing the Quinchía Gold Project—a multi-million ounce gold deposit in one of the world’s most prolific gold belts. With a completed PEA and 43-101 Technical Report showing $534 NPV at long term consensus $2,650/oz gold, and over $1.2B NPV at $3700/oz Gold, the upside at today’s $4,000+ prices is obvious.

Tiger Gold’s flagship Quinchia Gold Project is located in one of Colombia most exciting districts with a rich mining history, spanning over 500 years, and has fostered a pro-mining environment. The region’s industrial-based economy and strong regulatory framework make it highly attractive for mining investments and operations. The Mid-Cauca Gold Belt is rapidly becoming Latin America’s most exciting gold district home to dozens of multi-million ounce gold mines and discoveries. Major producers are expanding, new discoveries are being made, and the government has created a stable, mining-friendly regulatory environment.

Key Infrastructure and Economic Advantages

- 500+ Years of Mining History: Established mining culture and skilled workforce

- Established Infrastructure: Paved roads, abundant hydropower, available skilled labor

- Pro-Mining Government: Strong regulatory framework supporting responsible mining development and investment

- Recent PEA/Technical Reports: Tiger Gold’s 2025 PEA shows strong base economics

Disseminated on behalf of Tiger Gold Corp.

Cautionary Note Regarding Technical Information and Historical Mineral Resource and Reserve Disclosure

Certain details in this presentation with respect to the Quinchía Gold Project are derived from the technical report and preliminary economic assessment, titled “Quinchía Gold Project, NI 43-101 Technical Report & Preliminary Economic Assessment, Department of Risaralda, Colombia”, dated September 19, 2025 and with an effective date of September 18, 2025 (the “PEA”). The PEA was prepared by Ausenco Engineering Canada ULC, Moose Mountain Technical Services, and Aurum Consulting.. Any reference to capitalized terms, figures, tables or citations not included herein correspond to such items in the PEA.

2M+ oz

Gold Resource

US$534

PEA NPV @ $2,650 Gold

21%

IRR (Base Case)

140K oz

Annual Production Target

Permitted & De-Risked

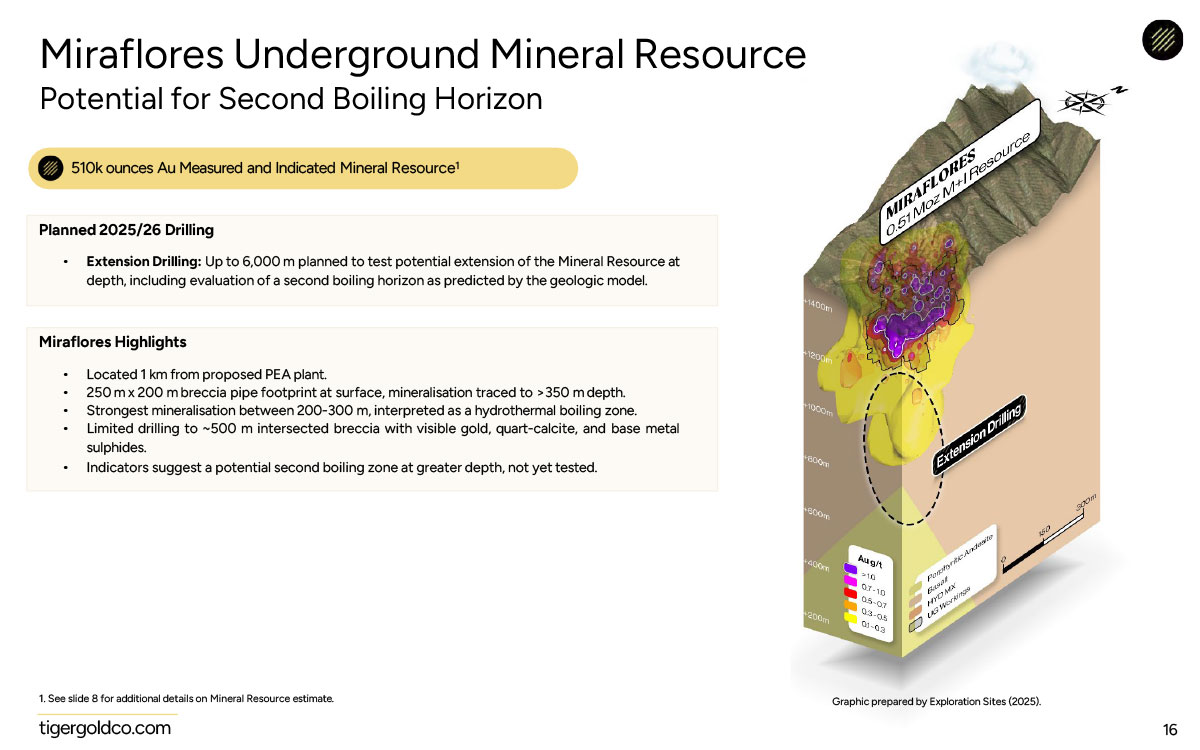

The Miraflores deposit received permits in 2024 and is ready for underground development. Extensive drilling by AngloGold Ashanti and B2Gold and most recently LCL Resources has de-risked the project significantly.

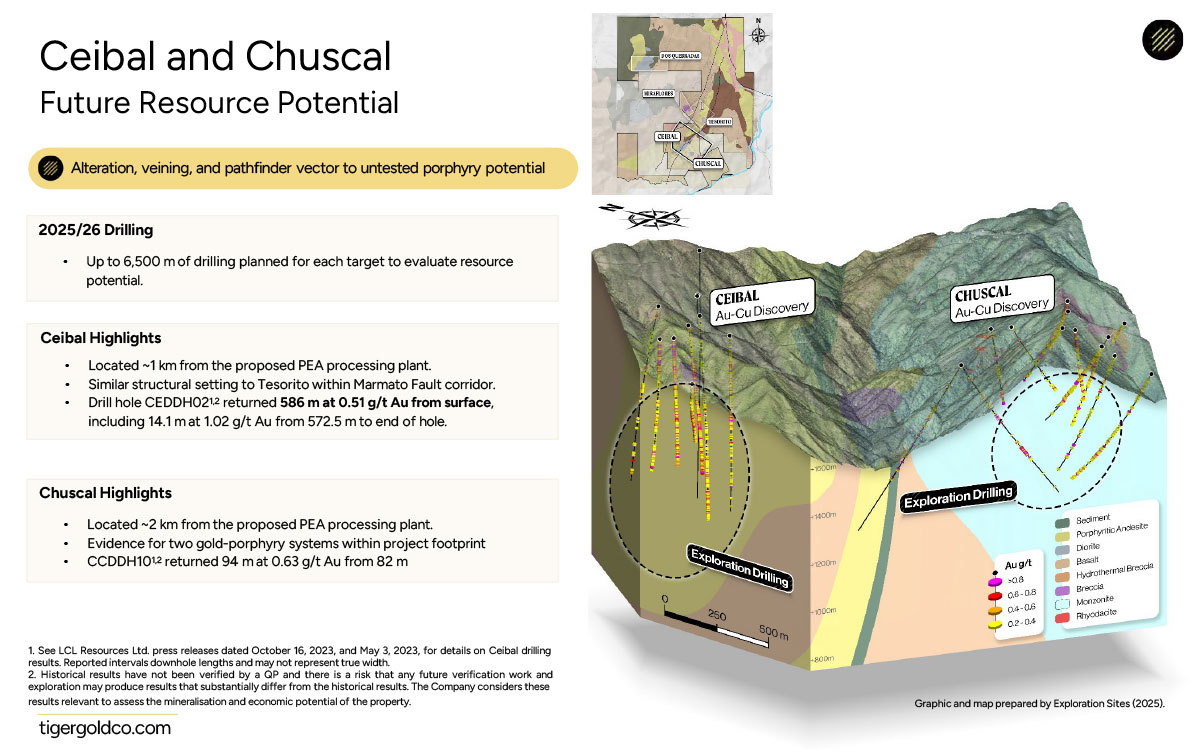

District-Scale Potential

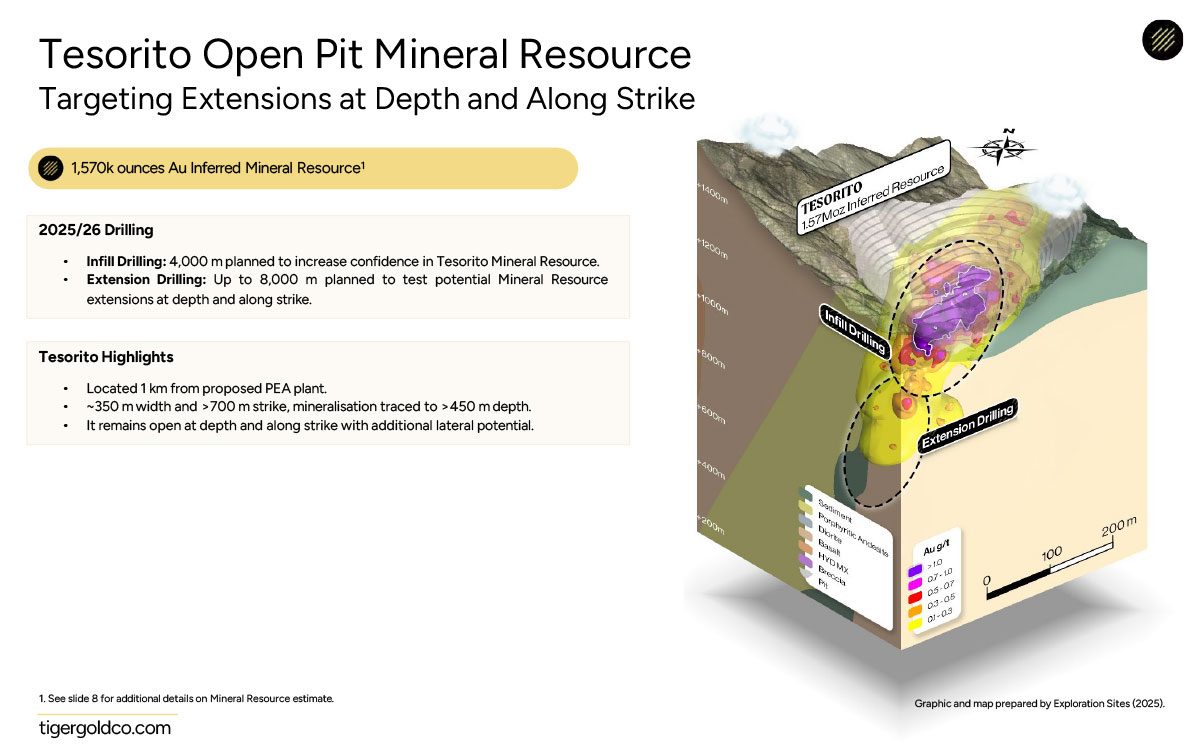

Multiple deposits within a 3km radius—Miraflores, Tesorito, and Dosquebradas—with significant exploration upside. The system may host 3-5M+ ounces total.

World-Class Team

A world class team of mine builders who have put numerous mines into production at global mining companies such as Barrick, Yamana Gold, B2Gold, AngloGold Ashanti, Pretium Resources, Detour Gold, NewGold Inc and Equinox Gold. Led by Robert Vallis (ex-Barrick, Yamana), this team has a long track record of created billions of dollars of shareholder value

Prolific Gold Belt

Located in Colombia’s Mid-Cauca Gold Belt, 20km from Aris Mining’s Marmato and Collective Mining’s Guayabales Project. Neighbors produce 400K+ oz annually.

Exceptional Entry Valuation

Valued at under $35M US at Listing ($.50 CAD), with comps trading on average at around $200M. Early investors gain exposure before the TSXV listing and broader market discovery.

Gold Price Optionality

Strong PEA economics of $534M US at $2,650/oz gold. With gold now above $4,000 and forecasts targeting $5,000+, the upside leverage is substantial—with the projects NPV exceeding $1.25B U.S. at $3,700 gold.

A Team That Has Built Mines Before

Tiger Gold’s leadership has collectively built, financed, and operated numerous world-class gold mines around the world. They’ve been on both sides of the table—running operations and executing multi-billion dollar M&A transactions.

Robert Vallis

President & CEO

28-year mining executive with 23 years at Barrick and Yamana. P.Eng., MBA. Led C-suite strategy, corporate development, M&A, and mine engineering across multiple continents. Now focused on unlocking Colombia’s next major gold mine.

Positioned for Growth

Milestones Achieved

Upcoming Catalysts

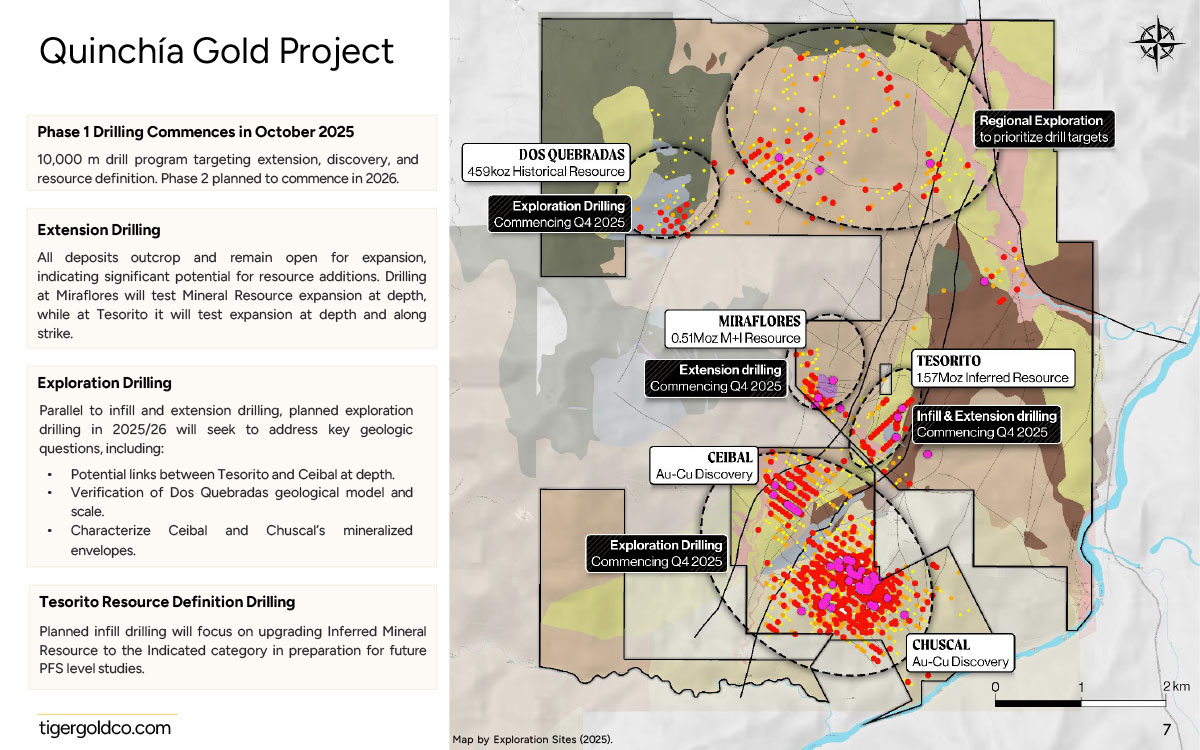

- Phase 1 drill program results and resource update

- Advance ESG initiatives and prior consultation

- Launch Phase 2 drill programs

- Phase 2 drill programs results

- Phase 2 Tesorito Mineral Resource estimate

- Phase 2 engineering and metallurgical studies

- Evaluate potential resource additions on PEA engineering assumptions

- Evaluate next steps for Phase 2 engineering

- Decision to proceed to PFS

Tiger Gold Outlook With Robert Vallis, CEO

Quinchia Gold Project

Proven Leadership

Management team and Board of proven mine builders with a strong global track record of creating shareholder value.

Multi-Million Oz Gold Deposit

Over 2M Oz of 43-101 Current Resources and growing.

Strong PEA Economics

2025 PEA valuation shows strong value in situ with $534M NPV at $2650/oz Au and over $1.2B NPV at $3700/oz Au.

Undervalued vs. Peers

Compelling upside and valuation *

Expanding Resources:

Drilling is underway to Expand Resources, Advance and De-risk the Project towards a PFS.

Looking for expert insights and early alerts?

Get Stock Alerts Instantly! Join EMC’s Exclusive WhatsApp and Telegram Groups For Savvy Investors

- There’s no obligation, and EMC delivers actionable Small Cap Stock Alerts straight to your phone and you inbox at no cost!

- Don’t miss out—subscribe and get an edge on your small cap investments!

Tiger Gold Corporate Presentation

Cautionary Note to United States Investors Concerning Estimates of Mineral Resources

The information contained in this document has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource,” and “Inferred Mineral Resource” or similar such terms used herein are Canadian mining terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (the “CIM Definition Standards”).

United States investors are specifically cautioned that:

- Inferred Mineral Resources: The estimation of Inferred Mineral Resources involves greater uncertainty as to their existence and economic or legal feasibility than other resource categories. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category.

- Prohibition on Economic Valuation (The Core Conflict): Pursuant to Subpart 1300 of Regulation S-K adopted by the U.S. Securities and Exchange Commission (the “SEC”), an Inferred Mineral Resource may not form the basis for an economic analysis, such as a Preliminary Economic Assessment (PEA), Net Present Value (NPV), or Internal Rate of Return (IRR), for public disclosure in the United States. The inferred valuations or economic analysis contained in this release are not compliant with SEC standards and should not be relied upon by U.S. investors.

- General Comparability: Mineral Reserve and Mineral Resource estimates prepared in accordance with NI 43-101 may not be directly comparable to similar information made public by U.S. domestic reporting companies subject to the reporting and disclosure requirements of the SEC.

Recent News

- Tiger Gold Commences Trading and Provides Project Update: Drills Turning at Quinchia – December 19, 2025

- Tiger Gold Corp. Announces Closing of Upsized RTO Financing and Prepares for Listing on the TSX-V – November 18, 2025

- Tiger Gold Corp Announces $15M RTO Financing Led by SCP Resource Finance – October 8, 2025

- Tiger Gold Completes First Option Payment to Acquire Multi-Million-Ounce Quinchía Gold Project and Becomes Operator – June 16, 2025

- Tiger Gold Announces LOI with Badger Capital for Proposed RTO on the TSX-V – June 13, 2025

- Tiger Gold to Advance the Quinchia Gold Project in Strategic Acquisition – May 14, 2025

Must Read OTC Markets/SEC policy on stock promotion and investor protection

COMPENSATION DISCLOSURE

EMC has been paid $200,000 by Tiger Gold Corp. | Please read our full disclaimer