Volt Lithium (“Volt”) is seeking to be the first commercial producer in North America to develop lithium from oilfield brine

Strategy to leverage hydrocarbon experience and infrastructure to extract lithium deposits from existing wells, reducing capital costs and lowering risk.

HIGHLIGHTS

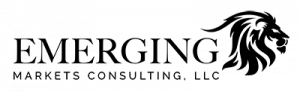

- Initial Rainbow Lake, Alberta asset represents worldclass resource

- Proprietary DLE technology

- Strategic partners include oil & gas producer and chemicals company with leading laboratory

- Clear path to production with pilot project anticipated in H1 2023 and commercial production by H1 2024

Developing battery metals for a greener tomorrow

Volt Lithium – Realizing its Commitment to Bring Necessary Green Energy Resource Assets Into Production in the Very Near Ter

Volt is committed to sourcing assets that can be taken into production near term, leveraging the experience of Executive Chairman Warner Uhl’s decades of experience in mining operations and equipment sourcing. This mandate made a union with Volt Lithium a very natural progression for the company.

Volt wants to emphasize the proprietary technology, the elimination of exploration risk, the infrastructure already in place and the sheer size of the asset in its possession.

- Volt aims to be North America’s first commercial producer of lithium from a brine going into pilot production by the end of Q1 2023.

- Massive lithium reservoir with 78 Billion Barrels of lithium-infused brine, concentrations up to 119 mg/L, yielding asset production life-cycle of 100+ years.

- Economical and economically insulated, with a projected cost of production a fraction of market value.

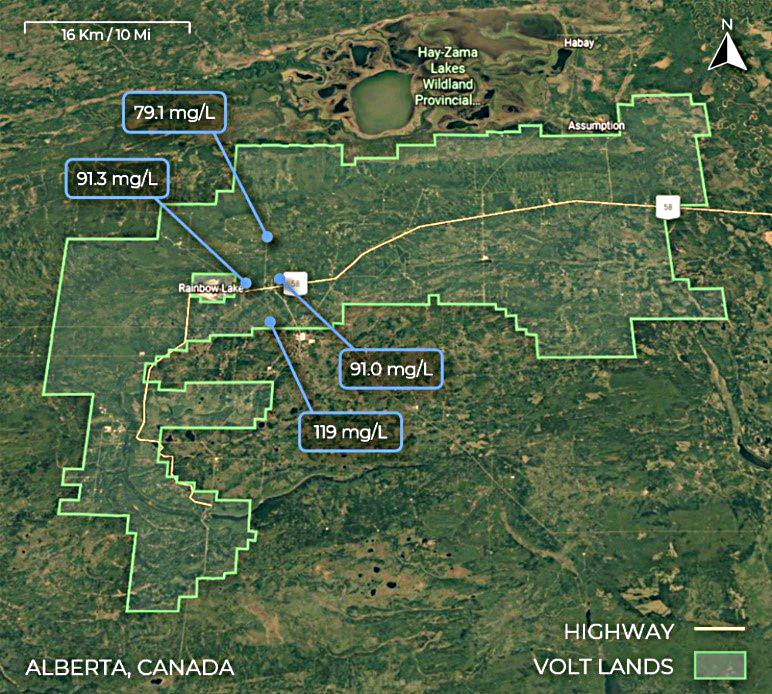

- Comparable in size and stage of development to companies like E3 Metals and LithiumBank but with a marketcap a fraction of the size.

- Proprietary Direct Lithium Extraction (DLE) technology provides high recoveries at low costs, making it a valuable IP asset and competitive advantage over other Li Brine assets outsourcing this technology.

- Infrastructure already in place, eliminating exploration risk and greenfield approvals, piggybacks on existing infrastructure, positioning the company to meet increasing demand for lithium.

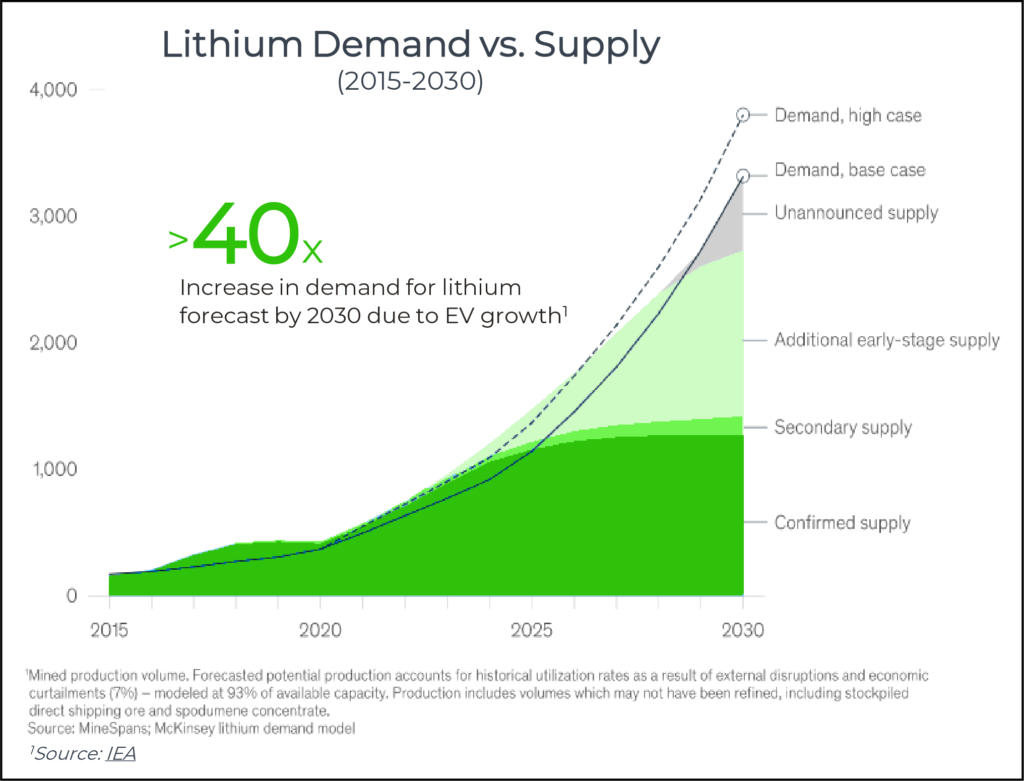

Supportive Lithium Market

Demand shows no signs of slowing, while confirmed lithium supply is flat

- Demand for lithium is rising as electric vehicles and renewable energy continue to gain ground

- Market faces insufficient lithium supply to meet demand for expanding EV revolution

- The most critical inputs in race to electrify the globe are lithium, copper and graphite

How Volt Produces Lithium

Four differentiating ‘pillars’ that position Volt for pilot production in 2023

- Agreement with oil producer, Cabot Energy

- Cabot produces lithium infused brine today – no exploration needed

- Management’s O&G background is key to project development

- Reservoir with 78 B barrels of lithium infused brine

- Highest lithium concentration tests in the basin = 119mg/L

- Veritable ‘ocean’ of brine provides longterm production

- Stage 1 = Remove contaminants from lithium infused brine

- Stage 2 = Vastly improved proprietary DLE process extracts lithium from brine

- Results in reduced capital costs

- No greenfield project approvals needed, a critical competitive advantage

- Existing infrastructure and operations streamline Volt’s process

World-Class Lithium Land Base

Alberta’s expansive lithium deposits are Volt’s initial target

Rainbow Lake Property

- Area with significant existing production infrastructure and wells

- Volt to determine optimal lithium concentrations across land base to maximize revenue

Recent News

- Volt Lithium Corp. Announces Management Change and Begins Trading on the TSX Venture Exchange Under the Stock Ticker Symbol “VLT” – April 27, 2023

- Allied Copper Announces 99.9% Shareholder Approval for Name Change to Volt Lithium Corp. and Election of Additional Board Member – April 21, 2023

- News Release for Early Warning Report Regarding Allied Copper Corp. – April 10, 2023

- Volt Lithium Announces Technical Breakthrough With Next-Generation IES-300 Proprietary Direct Lithium Extraction Process – April 6, 2023

- Allied Copper Announces Renewed Agreement With Emerging Markets Consulting, LLC – April 3, 2023

- Volt Lithium Meets Key Milestone With Start-up of Pilot Project – March 30, 2023

- Allied Copper Announces Option Grant – March 24, 2023

- Allied Copper Announces Proposed Name Change to Volt Lithium Corp, Addition of New Board Member and Voluntary Lock-up Agreements With Former Volt Shareholders – March 22, 2023

- Allied Copper Increases Non-Brokered Financing From $2,000,000 To $4,000,000 – February 10, 2023

- Allied Copper Announces Termination of Klondike Option Agreement – February 2, 2023

- Allied Copper Announces $2.0 Million Non-Brokered Financing – January 30, 2023

- Volt Lithium Announces 93% Lithium Recoveries From Its Proprietary DLE Technology – January 24, 2023

- Allied Copper Announces Corporate Update Including Lithium Concentrations Up to 91 mg/L in Volt’s Latest Field Activities – January 19, 2023

- Allied Copper Appoints Additional Director and Grants Stock Options – December 19, 2022

- Allied Copper Completes the Acquisition of Volt Lithium Corp. – December 9, 2022

- Allied Copper Intersects 4.26% Copper Over 1.06 Metres at West Graben Fault Target in Colorado – November 30, 2022

- Allied Copper Reports Additional Financial and Technical Information for Volt Lithium Corp. – November 24, 2022

- Allied Copper Enters Into Agreement to Acquire Volt Lithium Corp. – October 31, 2022

- Allied Copper Receives TSX-V Approval for Stateline Option Agreement – September 26, 2022

- Allied Copper Provides Update on Stateline Option Agreement – August 23, 2022

- 1,000 Metre Drill Program Underway At Allied Copper’s Klondike Property, Colorado – August 11, 2022

- Allied Copper Mobilizing for Drilling at the Klondike Property, Colorado in mid-July – July 12, 2022

- Allied Copper Completed UAV Magnetic Survey at the Klondike Property, Colorado – July 5, 2022

- Allied Copper Receives Permits at the Klondike Property, Colorado – June 22, 2022

- Allied Copper Files Technical Report for the Klondike Property, Colorado – April 26, 2022

- Allied Copper Completes 3D Induced Polarization (IP) Survey, SK Property, NV USA Large Anomaly Discovered – April 7, 2022

- Allied Copper Announces Appointment of Kyle Hookey as Interim CEO – March 25, 2022

- Allied Copper Hires Emerging Markets Consulting, LLC (EMC) For Investor/Public Relations Services – March 14, 2022

- Allied Copper Signs Option Agreement To Acquire 100% of Stateline Property, CO/UT USA – February 10, 2022

- Allied Copper Acquires Option to Acquire 100% Interest of Klondike Property, CO, USA – February 3, 2022

- Allied Copper Commences Induced Polarization (IP) Geophysical Survey, SK Property, NV USA – January 31, 2022

- Allied Copper Receives MMI Soil Sample Results For SK Property, Eastern Nevada, USA – January 11, 2022

- Allied Copper Signs Option Agreement To Acquire 100% of Klondike Property, CO, USA – December 7, 2021

- Allied Copper Corp. CEO Letter to Investors and Shareholders – November 17, 2021

Emerging Markets Report

- Breakthrough – April 14, 2023

- Technology is Key – April 5, 2023

- Supply and Demand – February 28, 2023

- A Better Mousetrap – January 26, 2023

Must Read OTC Markets/SEC policy on stock promotion and investor protection

Disclaimer

EMC has been paid $350,000 by Volt Lithium Corp. | Please read our full disclaimer