Axcap Ventures

CSE: AXCP; OTC: GARLF

Delivering North American Gold Exposure

SYMBOL: CSE: AXCP; OTC: GARLF

Disseminated on behalf of Axcap Ventures Inc.

- Outstanding Shares: 439,761,210 (as of 10/01/2025)

- Float: 103,510,649 (as of 04/30/2025)

- www.axcapventures.ca

Axcap Ventures Inc. (CSE: AXCP; OTC: GARLF) is an investment company whose primary objective is to identify promising investments with a focus on acquiring premier gold projects in North America.

Axcap looks for projects with established resources and expansion potential, where management’s extensive experience in deal sourcing and capital raising maximizes returns for the Company’s shareholders.

The Company invests its funds with the aim of generating returns from capital appreciation and investment income. It intends to accomplish these goals through the identification of and investment in securities of private and publicly listed entities across a wide range of sectors and industry areas, including but not limited to the mineral exploration, technology, software development and biotechnology industries.

Why Investing in Gold Mining Resources has Potential

Gold mining investments present compelling opportunities in 2025 due to several converging factors. Central bank policies and inflation concerns continue driving gold demand, while geopolitical tensions support safe-haven buying.

Many mining companies are generating strong cash flows at current gold prices, having improved operational efficiency after years of cost optimization. Supply constraints from aging mines and limited new discoveries are tightening the market. Additionally, the industry benefits from technological advances reducing extraction costs and environmental impact. With gold maintaining its historical role as a portfolio diversifier and inflation hedge, mining equities offer leveraged exposure to gold price movements while providing potential dividend income from profitable operations.

Growth Markets for Gold Resources in 2025

Technology and Electronics – Smartphones, computers, semiconductors, and emerging technologies like AI hardware require gold for conductivity and corrosion resistance in circuit boards and connectors.

Jewelry and Luxury Goods – Remains the largest consumer sector globally, with growing demand from emerging markets and premium jewelry brands expanding their offerings.

Medical and Healthcare – Gold nanoparticles in cancer treatments, dental applications, medical devices, and diagnostic equipment continue expanding as medical technology advances.

Renewable Energy and Green Technology – Solar panels, wind turbines, and electric vehicle components use gold for reliable electrical connections in harsh environmental conditions.

Aerospace and Defense – Critical applications in satellites, aircraft electronics, and military equipment where reliability and performance are paramount.

Financial Services and Investment – ETFs, central bank reserves, and institutional portfolios maintaining gold allocations for diversification and inflation protection.

Automotive Industry – Electric vehicles and advanced driver assistance systems require gold in sensors, circuit boards, and electrical components for enhanced performance and safety.

The global market for Fabrication Gold was valued at US$151.3 Billion in 2024 and is projected to reach US$203.7 Billion by 2030, growing at a CAGR of 5.1% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions.

Axcap's Assets

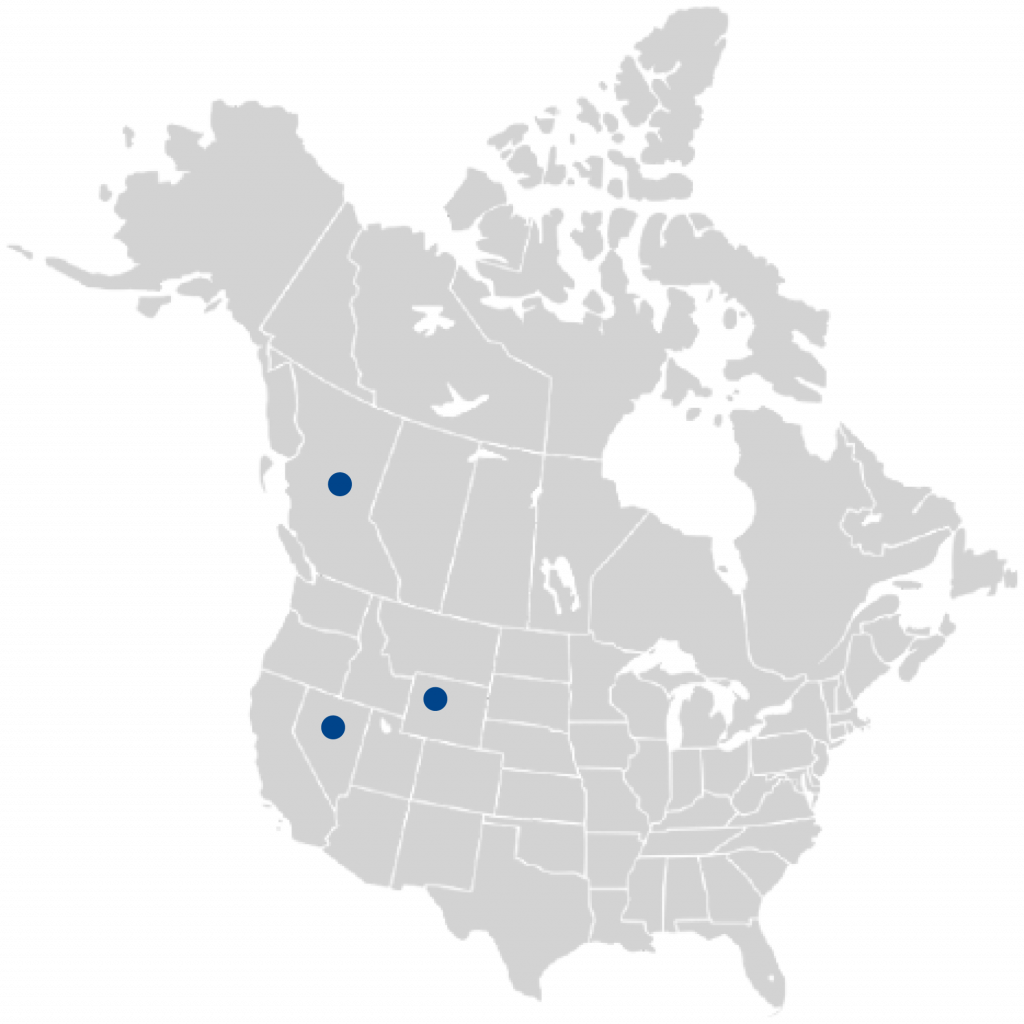

Axcap’s gold portfolio totals 6.18Moz Au of M+I and 1.69Moz Au of Inferred gold resources across 3 assets in North America.

The Company’s holdings span some of the most prospective gold belts in the United States and Canada, combining historical drilling success with modern exploration upside. From advanced-stage resources to discovery-stage opportunities, Axcap’s portfolio is built for scale.

- Axcap’s focus is on USA & Canada assets only

- Mining friendly jurisdictions with security of ownership

- Access to labour, services and infrastructure

- 7.9Moz at launch (~6.2Moz M&I and ~1.7Moz Inf)

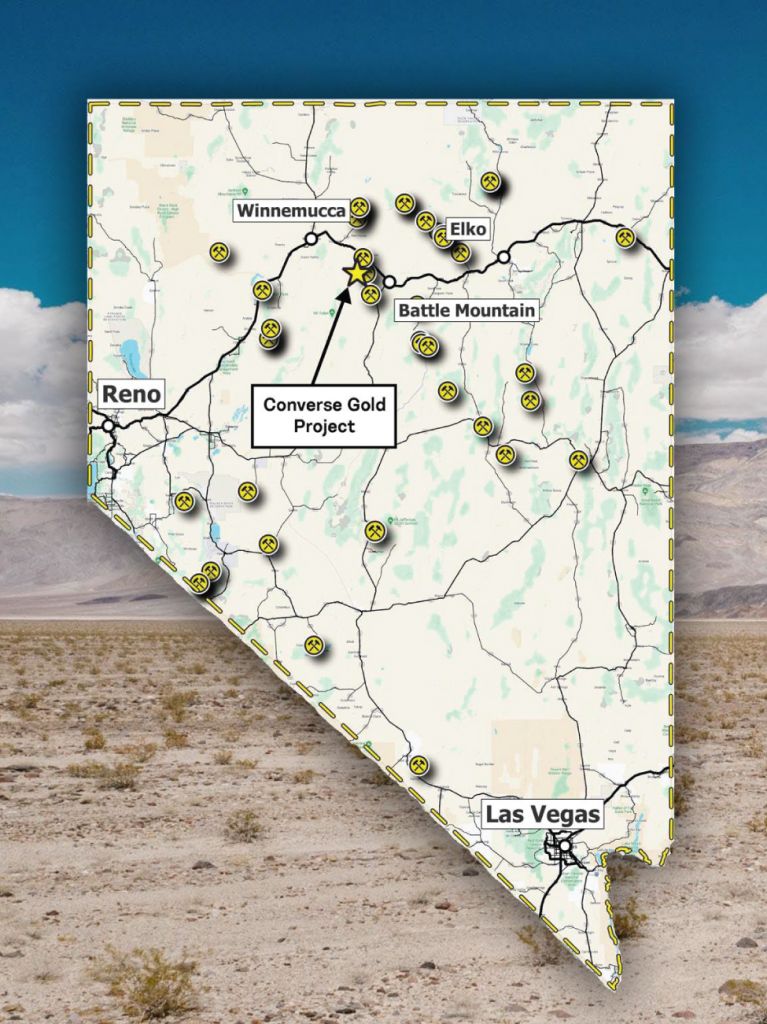

Converse (Nevada)

M&I: 5.57 Moz

Inferred: 0.42 Moz

Gold Price: $2,000/oz

Status: Drill-ready

Rattlesnake Hills (Wyoming)

Indicated: 0.61Moz

Inferred: 0.43 Moz

MI&I: 1.04 Moz

Gold Price: $1,950/oz

Newton (British Columbia)

Inferred: 0.84 Moz

Gold Price: $1,950/oz

Status: Drill-ready

Converse Gold Project

The Converse Gold Project is the largest undeveloped gold deposit not owned by a major mining company in Nevada – America’s premier mining state.

- Situated in the prolific Battle Mountain trend with current reserves and past production exceeding 50 million oz Au

- Nevada is a low-risk mining jurisdiction, has strong government and community support, and ranked 2nd in the 2024 Fraser InstituteAnnual Survey of mining jurisdictions

- The Converse project is permitted for exploration and has no

known impediments for open-pit operations

Exploration Upside

- Significant resource upside through future exploration

- Outside of the existing block model, exploration upside at the Redline deposit is interpreted to mostly exist at depth, which remains open

- Current resource run at US$2,000/oz

Rattlesnake Hills Gold Project

The Rattlesnake Hills Gold Project is located in Central Wyoming approximately 100 kilometres southwest of Casper on the western side of Natrona County. The Rattlesnake Hills Gold Project encompasses the Rattlesnake Hills Gold District nearly in its entirety and is a district scale gold exploration project comprising of 1,573 unpatented lode mining claims as well as 8 Wyoming State mining leases covering an area of approximately 30,400 acres.

Within the Rattlesnake Hills Gold Project, four significant zones of alteration and precious metal (gold and silver) mineralization have been identified that are associated with Eocene age alkalic intrusions at North Stock, Antelope Basin, South Stock and Blackjack. All four zones have been drilled and broad zones of low grade gold mineralization, as well as narrow discrete zones of high grade gold mineralization have been intersected

Newton Gold Project

LOCATED IN A PRECIOUS METALS DEVELOPMENT DISTRICT

The Newton property is located approximately 100 km west of the city of Williams Lake in central BC within a region characterized by plateau lands with gently rolling hills and other characteristics favourable to project development. The district is well served by existing transportation, power, infrastructure and a skilled workforce which support numerous operating mines as well as late-stage mineral development and exploration projects. Conditions are excellent for year-round exploration and development activities.

Newton is a bulk tonnage low-to-intermediate epithermal gold/silver deposit with analogous features to the Brucejack, Blackwater and Prosperity Deposits.

- ~180 km south of Artemis’ Blackwater Project (11.9M oz Au and 128M oz Ag)

- Blackwater was acquired from Newgold for $120M IN 2020

- Blackwater is permitted and in development to produce in 2024

- 50 km northeast of Taseko Mines Prosperity Deposit

(13.3M oz of Au & 5.3B lbs Cu)

Investor Presentation

Axcap Team

Mr. Dubeau is a seasoned equity and real estate investor. He is the current CEO of By the Bay Properties, a real estate company with its primary portfolio in Cape Breton, Nova Scotia. Prior to this, he spent fifteen years in government regulatory roles and private business. He has extensive experience in audit, operations management, and real estate management. Mr. Dubeau is a graduate of Kwantlen Polytechnic University with a Major in Accounting.

Mr. Vetro is an experienced investor and financier. He specializes in structuring and raising growth capital for resource companies. He is currently a partner at Vancouver based merchant bank, Commodity Partners, which co- founded TSX listed K92 Mining Inc. resulting in the renowned world class gold discovery and mining operation at Kainantu in Papua New Guinea. Mr. Vetro is a graduate of UBC with a major in Political Science.

Resources finance executive with 18 years of experience financing Latin American mining projects. CEO of Vista Gold (Peru). Former Head of LatAm Equities at Canaccord Genuity. Former Executive Chair at Silver X Mining. Former Partner & Head of Capital Markets at Peru’s largest independent brokerage firm.

Mr. Breytenbach is a former equity analyst at Cormark Securities and Stifel Canada where he interacted extensively with the international investment community. Prior to joining Aris Mining in 2022, Mr. Breytenbach was a Managing Director in the investment banking group at Canada’s largest employee-owned dealer – Cormark. Prior to entering capital markets, Mr. Breytenbach spent a decade in the mining industry as a geologist where he specialized in exploration, resource estimation and grade control. Mr. Breytenbach holds a BSc (Honours) Degree from Rand Afrikaans University in South Africa and is a designated P.Geo. He started his career under the Anglo Platinum Scholarship Program and has extensive experience in the Bushveld Intrusive Complex (the largest repository of magmatic ore deposits globally).

Blake Mclaughlin is a Chief Geologist – Near Mine Exploration at Argonaut Gold based in Toronto, Ontario. Previously, Blake was a Senior Geologist – Magino Project Leader at Argonaut Gold and also held positions at Red Pine Exploration, MacDonald Mines Exploration, Insight Geophysics.

Over 15 years experience in various CFO roles. Former Director of Finance at Alexco and former CFO of First Cobalt.

Mr. Lewins is a Mineral Engineer with over 35 years’ experience in the mining industry. He has previously worked in Africa, Australia, Asia, North America and the former Soviet Union. He is currently the Chief Executive Officer of the Company and served as Chief Operating Officer from May 2016 to August 2017. Mr. Lewins has successfully managed the development of a number of open pit and underground gold, precious and base metal mines from feasibility study through to profitable operations.

Mr. Lewins has operated extensively at the corporate level in various roles from Executive General Manager to Director and Chief Executive Officer with a number of other mining companies, including MIM Holdings, First Dynasty Mines, Platinum Australia and African Thunder Platinum.

Mr. Lewins received his National Diploma for Technicians (Extractive Metallurgy) from Technikon Witwatersrand, South Africa, a Bachelor of Science degree (Honours) in Mineral Engineering from University of Leeds, England and a Graduate Diploma in Management from University of Queensland.

Vice President, Corporate Development at Wesdome. Former equity research at Cormark and business development at Kinross.

Mr. Medilek is a mining professional with over 17 years of mining capital markets, corporate strategy and technical operating experience. Mr. Medilek joined K92 in 2019, most recently holding the position of President, and prior to that was its Vice President Business Development and Investor Relations. Previously, Mr. Medilek was an equity research analyst covering precious metals companies, with Macquarie Group Limited; a mining investment banker with Cormark Securities Inc.; and a mining engineer with Barrick Gold Corporation in Western Australia. Mr. Medilek holds a Bachelor of Applied Science in Mining Engineering with Distinction from the University of British Columbia, a Professional Engineer designation in the Province of British Columbia, and is a CFA ® charter holder*. (*CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.)

Senior Partner and Equity Analyst and Cormark Securities.

Recent News

- Axcap Initiates Preliminary Economic Assessment on Converse Project, Targets Q2 2026 Completion – October 23, 2025

- Axcap Announces Closing of Upsized $9.2 Million Financing – October 22, 2025

- Axcap Announces Fully Subscribed C$8.2 Million Financing With a Strategic Investor Acquiring 9.9% of the Company – October 14, 2025

- Axcap Closes C$12.5 Million Concurrent Offering – September 23, 2025

- Axcap to Join Forces with Former Principals of Roxgold to Advance the Large Converse Gold Project in Nevada – September 8, 2025

- Axcap Ventures Extends Milestone Payment Deadline With Waterton – August 12, 2025

- Axcap Continues to Discover New High Grade Zones at Converse – August 7, 2025

- Axcap Ventures Commences Converse Project PEA Engagement – July 17, 2025

- Axcap Announces Investor Relations Agreement – July 3, 2025

- Axcap Ventures Identifies High-Grade Zone Below Pit Shell at Converse – June 16, 2025

- Axcap Ventures Announces Minimum Share Ownership Policy With Board of Directors and Senior Executives – June 12, 2025

- Axcap Shareholders Agree to Voluntary Lockup of 96 Million Shares, Representing over 57% of the Shares Issued Under its $0.06 Unit Offering – May 29, 2025

- Axcap Signs Definitive Mineral Property Purchase Agreement Acquiring the Newton Gold Project Located in British Columbia, Canada – May 26, 2025

- Axcap Ventures Announces At-The-Market Offering of p to $20 Million – May 26, 2025

- Axcap Announces Investor Relations Agreements – May 2, 2025

- Axcap Ventures Issues Corporate Update Highlighted by Receipt of Final Prospectus and Summary of Acquisitions Totaling 6.18m oz of M+I And 1.69m oz of Inferred Gold Resources – April 29, 2025

- Axcap Announces Automatic Conversion of Special Warrants – April 24, 2025

- Axcap Files Amended and Restated Financial Statements, MD&A and Annual Information Form – April 15, 2025

- Axcap Ventures, Inc. Announces Closing of the Converse Transaction – February 25, 2025

- Axcap Ventures Closes Third and Final Tranche of Previously Announced Oversubscribed Special Warrant Non-Brokered Offering – February 3, 2025

CAUTIONARY DISCLOSURE ABOUT FORWARD-LOOKING STATEMENTS

The information contained in this publication does not constitute an offer to sell or solicit an offer to buy securities of the Company. This press release contains forward-looking statements, which are not guarantees of future performance and may involve subjective judgment and analysis. The information provided herein is believed to be accurate and reliable, however the Company makes no representations or warranties, expressed or implied, as to its accuracy or completeness. The Company has no obligation to provide the recipient with additional updated information. No information in this publication should be interpreted as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

The scientific and technical information in this article has been reviewed and approved by Blake Mclaughlin, PGeo. Vice President Exploration of Axcap, who is a “Qualified Person” as defined under National Instrument 43-101 – Standards of Disclosure for Minerals Projects.

Must Read OTC Markets/SEC policy on stock promotion and investor protection

Disclaimer

EMC has been paid $400,000 by Axcap Ventures Inc. | Please read our full disclaimer