The Market: A $700B Orbital Economy

The global shift into space infrastructure is backed by extraordinary forecasts:

- Orbital Infrastructure: USD $13.5B in 2024 → $21.3B by 2029 (CAGR ~9.6%)

- Global Satellite Market: projected USD $615B by 2032

- In-Orbit Data Centers: USD $1.77B in 2029 → $39.1B by 2035

- Satellite Data Services: ~$12.16B in 2024 → ~$55.24B by 2034 (CAGR ~16.3%)[8]

THE TAKEAWAY IS SIMPLE:

What the internet was in 1995—uncharted, chaotic, and full of first-mover gold—Orbit could become.

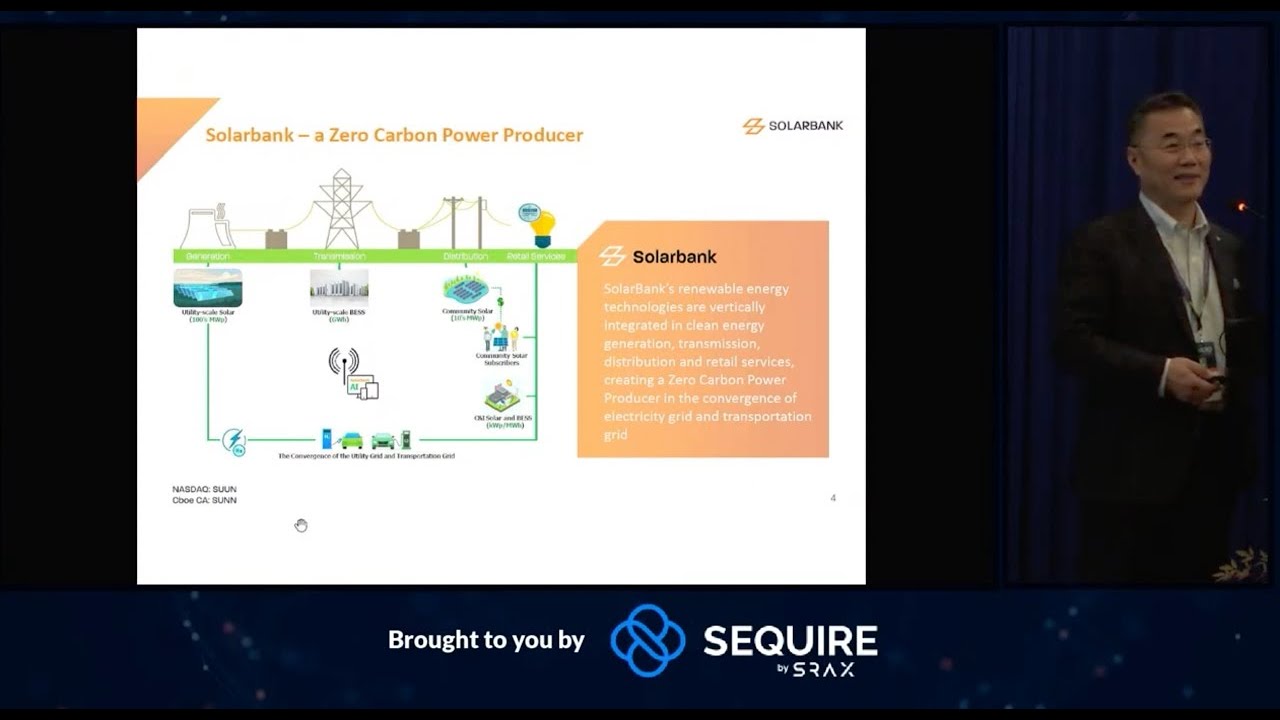

And PowerBank (NASDAQ: SUUN) is gaining exposure at the earliest stage of this generational shift.